Empower yourself with Financial Knowledge

Blogs

Smart Lifestyle

What Is Feminine Energy? 6 Ways to Be More Feminine

Smart Lifestyle

15 Signs You’re a High Value Woman

Smart Lifestyle

How to Handle Conflict in Relationships: 7 Tips and Strategies

Personal Finance

Benefits of Niramaya Health Insurance for Persons with Disabilities

Smart Lifestyle

Daily Habits of Successful Entrepreneurs in 2025

Smart Lifestyle

How to Say No Professionally at Work Without Feeling Guilty

Smart Lifestyle

5 Types of Leadership Styles and Their Impact on Your Team

Smart Lifestyle

5 Ways to Increase Income Sources

Education

10 Benefits of Mentoring Programs

Smart Lifestyle

5 Ideas on What to Buy with First Salary

Smart Lifestyle

What Is Slow Living and Why More Women Are Choosing It?

Smart Career

7 Best Steps to start a Successful Business?

Smart Career

How to Explain a Career Gap in an Interview?

Smart Lifestyle

5 Common Financial Problems and How to Overcome Them?

Smart Lifestyle

Why Women Make Better Investors Than Men (Sorry, Not Sorry!)

Smart Money

10 Steps to Becoming a Millionaire

Retirement

Top 6 Investment Options for Senior Citizens

Lifestyle

10 Rare Signs That You’re a Sigma Female

Mutual Funds

How To Invest in Gold Mutual Fund Through SIP?

Smart Career

How to Build a Powerful Personal Brand as a Woman

Smart Lifestyle

How to Plan Your Dream Solo Trip Without Breaking the Bank

Smart Lifestyle

10 Money Questions to Ask Your Partner Before You Commit

Mutual Funds

What Is NFO and How Can Investors Benefit from It?

Money Matters

How the 8th Pay Commission Could Impact Women?

Mutual Funds

Saving

8 Best Saving Schemes for Women in India

Personal Finance

How to Build a Financial Safety Net for Your Family’s Future

Relationship

How to Balance Financial Goals in a Relationship

Lifestyle

Top 10 Books Every Woman Should Read

Money Hacks

Saving

10 Money Saving Tips for Housewives

Career

Lifestyle

Problems of Working Women

Career

Lifestyle

Reasons Why Financial Independence is Important for Women

Education

Role of Education in Women Empowerment

Career

Education

40 Important Goals For Teenage Girls Must Have

Money Matters

What is the Unified Pension Scheme and How Does It Work?

Mutual Funds

10 Reasons to Invest in Equity Market

Money Matters

What is CDSL Easi and How to Register for It?

Relationship

Building a Healthy Mother-Daughter Bond

Mutual Funds

Parenting

Saving

Best Investment Options for a Girl Child – Secure Her Future

Personal Finance

Overall Net Worth VS Liquid Net Worth: What’s The Difference

Insurance

10 Top Benefits of Health Insurance

Money Matters

Top 7 Government-Backed Instant Loan Schemes for Women

Personal Finance

Step-by-Step Guide to Apply for Ladki Bahin Yojana 3.0

Career

Smart Career

High-Paying Home Jobs for Ladies Who Want Financial Independence

Mutual Funds

What is the difference between SIP and Mutual Fund?

Lifestyle

Understanding 6 Female Personality Types

Money Matters

What is Nifty and Sensex?

Money Matters

How to Earn Money Online Without Investment in 2025?

Money Matters

Why Hybrid Funds Are Smart Choice for Women Investors?

Money Matters

How to Apply for Mahila Samman Savings Scheme?

Smart Lifestyle

7 Effective Strategies to Manage and Overcome Burnout at Work

Money Matters

5 Best Ways to Prepare For a Recession

Budgeting

Top 3 Benefits of SIP in Mutual Funds

Smart Lifestyle

Step-by-Step Guide to Applying for Mudra Loan Scheme For Women

Smart Career

10 Inspiring Stories of Women in Finance

Lifestyle

Parenting

How the Sukanya Samriddhi Yojana Can Help You Save for Your Daughter’s Future

Money Matters

Why is Diwali the Perfect Time to Buy A Home?

Smart Lifestyle

7 Best Business Ideas for Teens To Make Money

Education

Lifestyle

5 Essential Financial Lessons to Learn in College Days

Lifestyle

Money Hacks

10 Best Ways To Make Money From Your Phone

Lifestyle

7 Simple Ways to Save Money This Diwali

Money Hacks

5 Effective Ways to Save Money

Money Matters

How to Open a Business Bank Account?

Lifestyle

Money Hacks

Financial Wisdom from Maa Durga’s 9 Avatars During Navratri

Personal Finance

10 Personal Finance Questions to Ask Yourself Today

Smart Money

Lxme’s Emergency Fund Savings Challenge-5K

Career

Smart Career

17 Best Online Side Hustles to Start from Home in 2024

Lifestyle

How to Boost Your Confidence as a Woman

Personal Finance

How to Set and Reach Your Personal Goals

Lifestyle

Creative Home DIY Ideas for Women

Personal Finance

Budget 2024: Key Takeaways for Women

Insurance

Lifestyle

Importance of Personal Finance for Women in India

Insurance

Retirement

What are Annuities & How They Work

Gold

Sovereign Gold Bond

Money Hacks

Retirement

5 Financial Mistakes to Avoid To Secure Your Future

Mutual Funds

Saving

7 Reasons Women Should Have Emergency Savings

Mutual Funds

Saving

A Simplified Guide To Financial Planning for Women In India

Education

Mutual Funds

Parenting

Lxme’s Child Education Plan: An Expert curated portfolio

Lifestyle

Saving

Tips to Save Money on Utility Bills

Lifestyle

Money Hacks

Positive Money Mindset Tips for Women

Lifestyle

Money Hacks

5 Things One Can Do Right Now to Manage their Finances Effortlessly

Mutual Funds

Retirement

Saving

Conquer Your Future: Best SIP Plans for 30 Years and Building Financial Freedom with Lxme

Career

Lifestyle

Steps to Prevent or Handle Workplace Harassment

Credit Card

Money Hacks

Credit cards can be magic cards when used correctly!

Lifestyle

Money Hacks

Saving

5 Mind-Blowing Money Saving Hacks!

Lifestyle

10 Best Hobbies For Women

Mutual Funds

Saving

Saving vs. Investment: Which is better?

Career

Saving

Active Income vs Passive Income: Know the Difference

Mutual Funds

Investment Vs Trading: Which One is Better for You?

Mutual Funds

Index ETF vs Index Fund: Understand the Difference

Mutual Funds

Step by Step Process to CAMS nominee update

Career

Lifestyle

15 Low Stress Jobs that Can be Done Remotely

Mutual Funds

Mutual Fund Investment Guide for Beginners

Career

Mutual Funds

Mutual Funds vs. Hedge Funds: Unveiling the Right Choice for You

Mutual Funds

Saving

Fixed Deposits vs. Mutual Funds: Unveiling the Best Fit for Your Financial Goals

Mutual Funds

Types of Mutual Fund

Career

Lifestyle

# Effective Communication Skills for Women

Mutual Funds

How to Determine Investment Objectives?

Relationship

Relationship Advice for Women

Lifestyle

Parenting

12 Pregnancy Tips for First Time Moms

Saving

Travel

8 Humble Travel Tips and Tricks to Travel Luxe Locales

Money Hacks

Saving

Diamonds Aren’t Just for Jewelry: A Guide to Investing in Diamonds

Mutual Funds

Standard Deviation in Mutual Fund

Saving

Shopping

Budget-Friendly Clothing Ideas for Women in 2024

Shopping

Mother’s Day Gift Ideas for 2024

Lifestyle

Relationship

15 Ways To Manage Finances After Divorce

Mutual Funds

Bear and Bull Market: What’s the Difference?

Career

Money Matters

What is Udyogini Scheme? Features, Eligibility & Documentations

Career

Lifestyle

9 Ways to Achieve Better Work Life Balance for Women

Career

Parenting

13 Ways to Make Money as a Stay-At-Home Mom

Gold

Mutual Funds

Gold Mutual Funds vs Gold ETF: Understand the Difference

Lifestyle

Saving

Smart Moves: What to Do with Excess Cash | 4 Expert Financial Tips

Mutual Funds

Is it Good to Withdraw Profit from Mutual Funds?

Mutual Funds

Saving

Can One Start SIP with 500 Per Month?

Lifestyle

Money Hacks

6 Ideas to Ease Your Financial Burden during Pregnancy Period

Career

Education

How Important is Financial Literacy for Modern Day Women in India

Insurance

Loan

How to Apply for a Personal Loan for Medical Emergency?

Insurance

Mutual Funds

ULIP Vs Mutual Funds: Which is the Better Investment Option?

Mutual Funds

Investment Strategies During Economic Downturn

Mutual Funds

Retirement

Early Retirement Planning Guide: Secure Your Future Today

Mutual Funds

Importance of Investing In Passive Income Sources

Credit Card

What Is Credit Score & How To Improve It

Mutual Funds

Saving

2 Lies and a Truth: Money Management

Mutual Funds

Tax

Tax Planning Strategies for Mutual Fund Investors

Mutual Funds

Saving

How to Become Rich as a Woman – An Excellent Guide

Career

Saving

EPF Vs. PPF: Which is the Better Option?

Lifestyle

Retirement

How to Retire at 50? – A Comprehensive Plan

Mutual Funds

How should you analyse the Mutual Fund?

Lifestyle

Mutual Funds

Why Investing Today Means ‘Future You’ Will Thank You

Mutual Funds

Saving

Choosing Wisely: Debt Mutual Funds vs Fixed Deposits Explained

Mutual Funds

Investment Options to Beat Inflation Rate in India

Mutual Funds

Things to Check before Investing in a Mutual Fund

Mutual Funds

Saving

SIP Vs Lumpsum: Which Method is better for Women?

Mutual Funds

Mutual Fund Vs. Stock: Where should you invest?

Mutual Funds

Understanding ETFs: Exchange Traded Funds

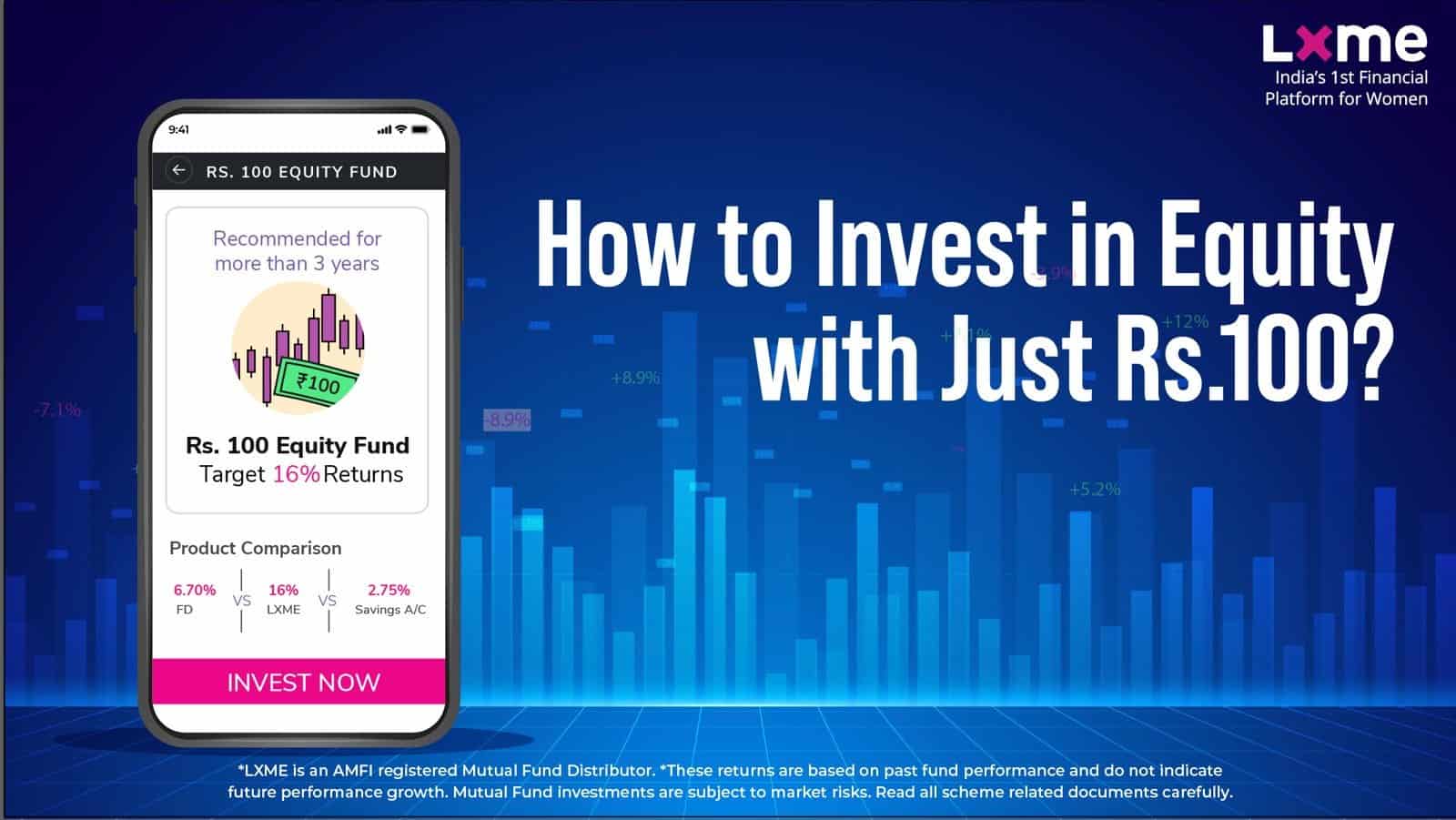

Mutual Funds

How to Invest in Equity with Just Rs. 100?

Mutual Funds

Start Investing Early: The Key to Financial Success

Lifestyle

Loan

Buying Vs. Renting Home

Insurance

Health Insurance for Women

Mutual Funds

Saving

Master the Path: How To Make 1 Crore In 15 Years

Mutual Funds

Saving

Crypto Currency or Mutual Funds: Where Should You Invest

Lifestyle

Mutual Funds

Financial Planning for Women: Expert Guidance for a Secure Future

Money Hacks

Mutual Funds

Saving

How to start investing with low income

Mutual Funds

Is PPF better than SSY?

Saving

Shopping

How to Shop Smart and Save Money? Guide for Women

Mutual Funds

Is SIP better than RD?

Lifestyle

Money Hacks

SMART WAYS TO USE YOUR DIWALI BONUS

Gold

Mutual Funds

How To Invest in Gold This Dhanteras 2023?

Gold

Mutual Funds

Saving

Should you invest in the Gold Chit Fund?

Saving

Tax

Is FD risk free?

Mutual Funds

Saving

Your Salary Just Got Credited – Here’s How to Invest It Wisely with Mutual Funds

Gold

Mutual Funds

Parenting

How to Plan on Buying Gold Jewelry for Your Child’s Wedding?

Lifestyle

Money Hacks

Mutual Funds

Investing According to Your Money Personality: A Guide to Financial Success

Career

Lifestyle

Restarting Your Career After a Break: Tips for Success

Mutual Funds

Parenting

Saving

Financial Planning for Your Baby’s Future: A Comprehensive Guide for Indian Moms

Lifestyle

Money Hacks

How to Make the Most of Raksha Bandhan Gift Money?

Retirement

Tax

NPS: What are the tax benefits and who should invest?

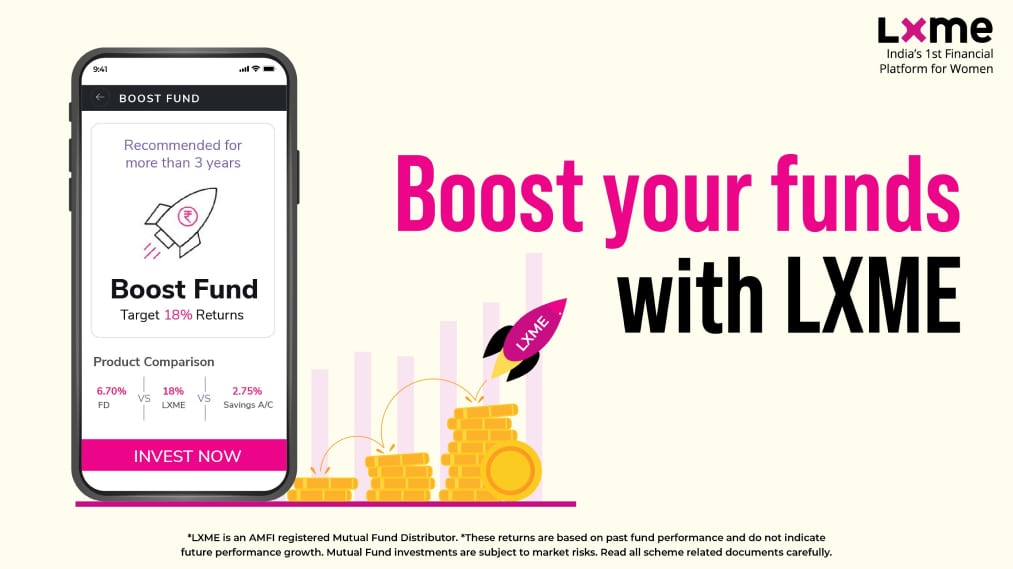

Mutual Funds

Lxme BOOST FUND

Lifestyle

Tax

A Simplified Guide to Income Tax for Housewife

Lifestyle

Money Hacks

Lxme’s Silver Membership Program

Money Hacks

Mutual Funds

Retirement

7 Best Tips for Investing in Your 50s: Securing Your Financial Future

Parenting

Saving

Smart Saving Tips: How to Save Money as a Single Mom

Career

Mutual Funds

Thriving in Your 40s: Unveiling the 7 Best Tips for Smart Investing

Career

Money Hacks

How to invest your bonus/appraisal money?

Lifestyle

Relationship

5 Questions To Ask Before Splitting Your Expenses With Your Partner

Career

Money Hacks

7 best tips to invest in 30s

Lifestyle

Loan

Mutual Funds

What to Do After Becoming Debt-Free

Education

Mutual Funds

Parenting

Best Investment for Child Education: Exploring Options for a Boy Child

Money Hacks

Mutual Funds

Right time to withdraw your investments?

Career

Parenting

Simple Money-Making Ideas for Stay-At-Home Parents

Money Hacks

Tax

Simple Checklist to Make Filing Your Taxes Easier

Mutual Funds

Empowering Women to Invest in Mutual Funds in 2023

Budgeting

Money Hacks

Saving

How to Create a Budget You’ll Stick To

Lifestyle

Relationship

What Are The Red Flags In A Relationship

Mutual Funds

Tax

ELSS Tax Benefits: Understanding Tax Bachao, Lxme Badhao

Lifestyle

Relationship

Streedhan: A Woman’s Right

Lifestyle

Loan

How to get an Instant Personal Loan for Home Renovation?

Lifestyle

Money Hacks

10 Demons To Kill This Dussehra

Mutual Funds

Retirement

EPF Advance- Should you withdraw from your PF account?

Gold

Mutual Funds

What is Asset Allocation and Why It Matters

Money Hacks

Portfolio Management Service #NewbieInvestor

Money Hacks

Portfolio Management Service #AdvancedInvestor

Money Hacks

Mutual Funds

Unlock Prosperity: Long-Term Wealth Creation Strategies

Education

Parenting

Crafting Tomorrow: How to Plan for Child Education Success

Loan

Mutual Funds

Saving

Uncategorized

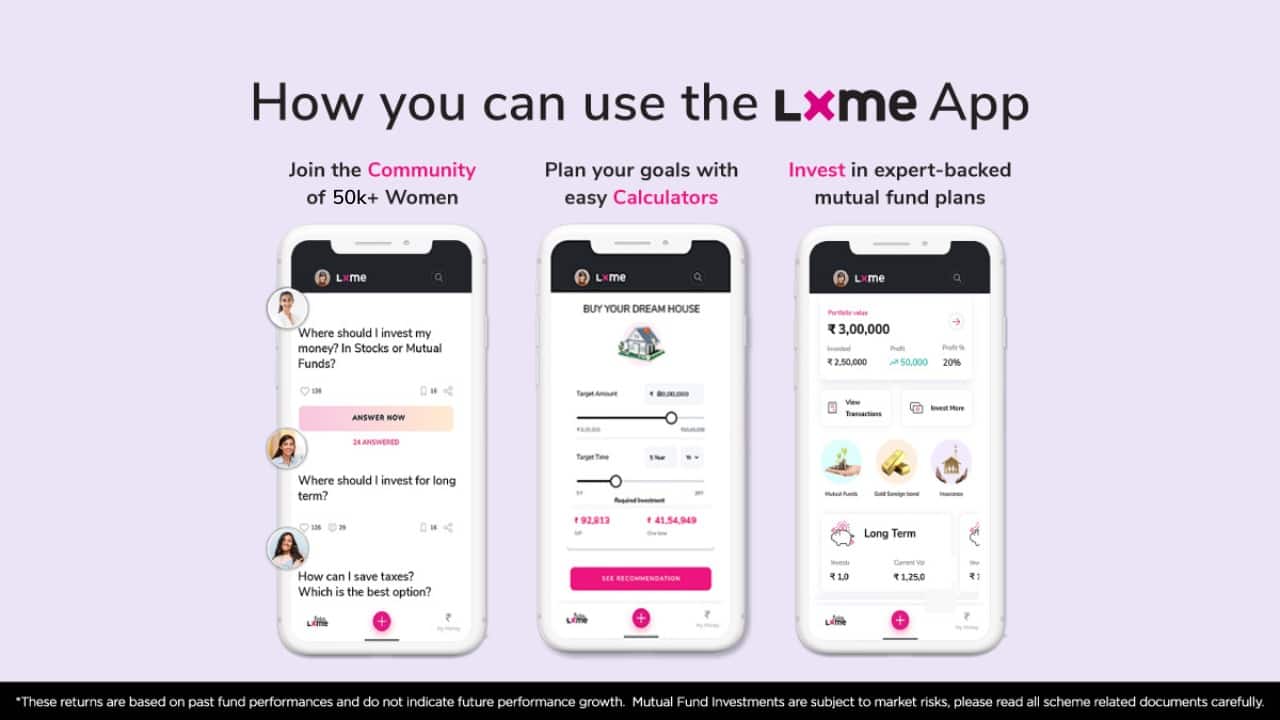

Welcome to Lxme! Here is how you can use the Lxme App. Read to know more

Retirement

National Pension Scheme #AdvancedInvestor

Money Hacks

Mutual Funds

Here is why you can trust Lxme with your conversations and your MONEY! Read More

Lifestyle

Money Personality Types – The Dreamer

Lifestyle

Saving

Lxme’s 2021 Year in review!

Retirement

What is National Pension Scheme (NPS)?

Loan

Mutual Funds

Saving

How to use the Lxme App?

Education

Mutual Funds

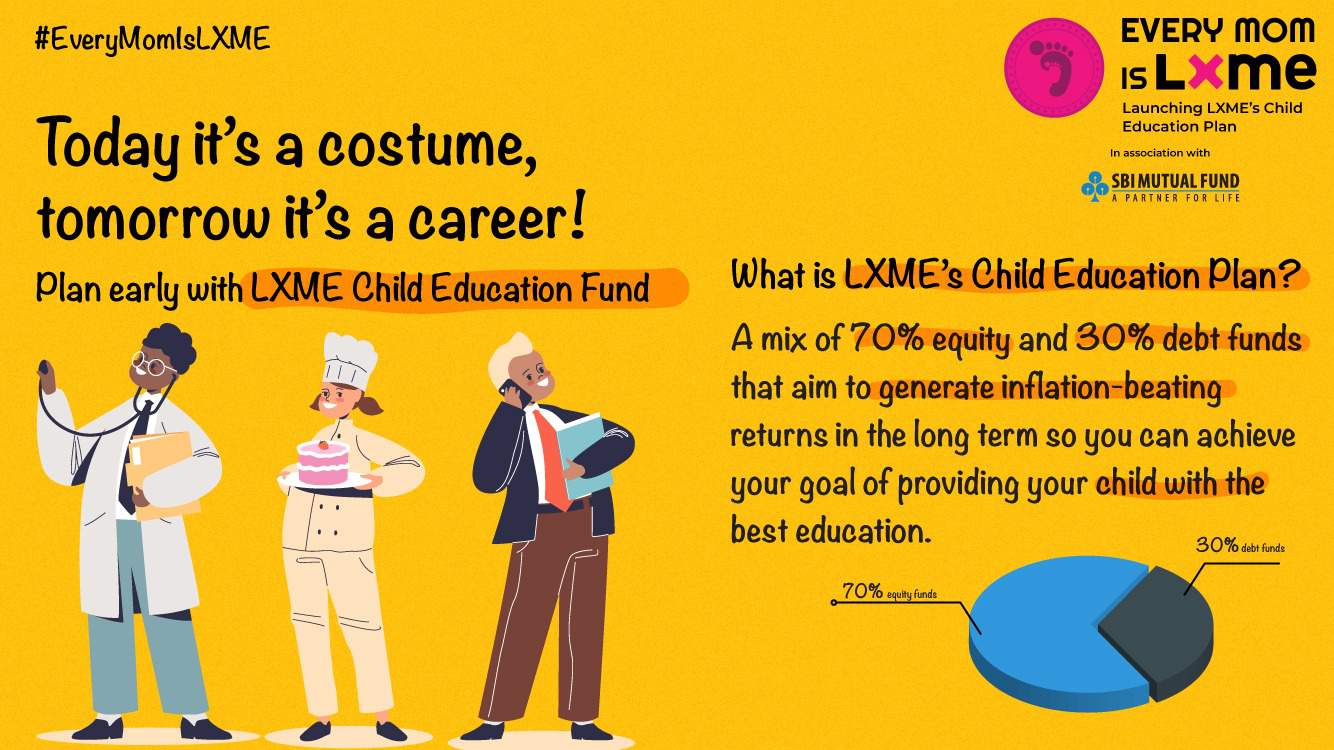

Parenting

Empower Your Child’s Future with Lxme’s Child Education Plan in India

Credit Card

The Best Card for You: Debit or Credit?

Mutual Funds

Saving

Best Mutual Fund Plan: Girls with Goals – Lxme Portfolio

Mutual Funds

Saving

SIP for Beginners: A Beginner’s Guide to Understanding SIP

Money Hacks

Retirement

FIRE: Hack how to retire early ?

Money Hacks

Shopping

Buy Now, Pay Later: The Ultimate Guide for Smarter Shopping

Lifestyle

Parenting

Will – A simple yet effective Estate Planning

Money Matters

Financial Goal Planning

Mutual Funds

Uncategorized

All you need to know about Index Funds

Money Hacks

Decoding Stock Market Indices

Credit

Lifestyle

All you need to know to get a Good Credit Score!

Uncategorized

Inflation: That’s Not All!

Money Hacks

No fail ways to Maximise your Earnings

Mutual Funds

Saving

What are emergency funds and why should everyone have one?

Relationship

Saving

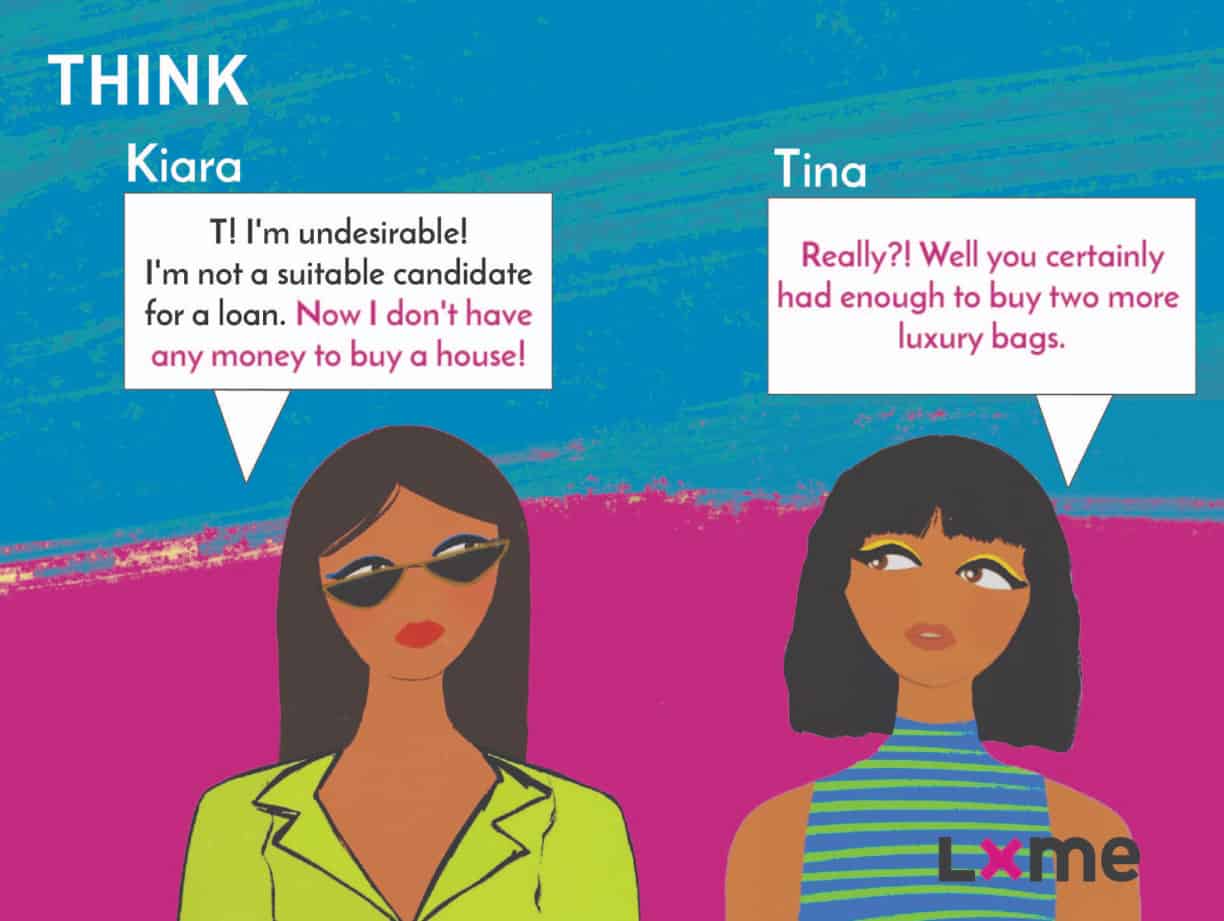

4 Signs of a Financially Draining Relationship

Lifestyle

Money Hacks

Shopping

#WeddingShenanigans: Rent-a-Fashion

Insurance

Saving

4 Ways to Prevent Those Steep Medical Bills

Career

Saving

5 Reasons to Pay Yourself Even When You’re Starting Up

Lifestyle

Saving

Shopping

Wedding Shenanigans That Won’t Drain Your Wallet

Lifestyle

Shopping

5 Presents To Demand From Your Sibling This Rakhi