Since the year 2004, KYC guidelines have been put in place by the Reserve Bank of India. The Prevention of Money Laundering Act requires banks, financial institutions, and intermediaries to ensure that they follow certain minimum standards of KYC to verify both the identity and address of all customers who are to carry out any kind of financial transactions with them. To do so without too many logistical inefficiencies, the KYC process was introduced by the RBI as the only mode of verification. Hence, KYC is an effective way to streamline the process of verifying the authenticity of our customers.

What is KYC?

KYC i.e Know Your Customer, is a verification process that allows us to confirm and thereby verify the authenticity of our customer. This authenticity is to be sure of the identity and the address of the customer.

Every existing and authorized financial institution, bank, or other organization where financial transactions are carried out is mandated by the RBI to do the KYC process for all customers prior to giving them the right to carry out any financial transactions. This is simply a one-time process that comes as part and parcel of opening an investment account.

Why is KYC important?

Now that we understand that KYC exists for every financial institution in India, here’s why KYC is important.

Essentially, to be able to carry out any financial transaction you will have to go forth with KYC. When you get your KYC verification process done, you have given us the information about your identity, address, and financial history. This can aid us in knowing that the money you choose to invest is not for any illegal or money laundering related purpose.

What is the process for KYC registration?

When you start the process to open an investment account with LXME, the first step is to check your KYC verification on the Investment Ready page. Here, you will be asked to enter your PAN number and date of birth. LXME will fetch your KYC details using this information. If you are already KYC compliant, you can verify your details and move on to the account opening process.

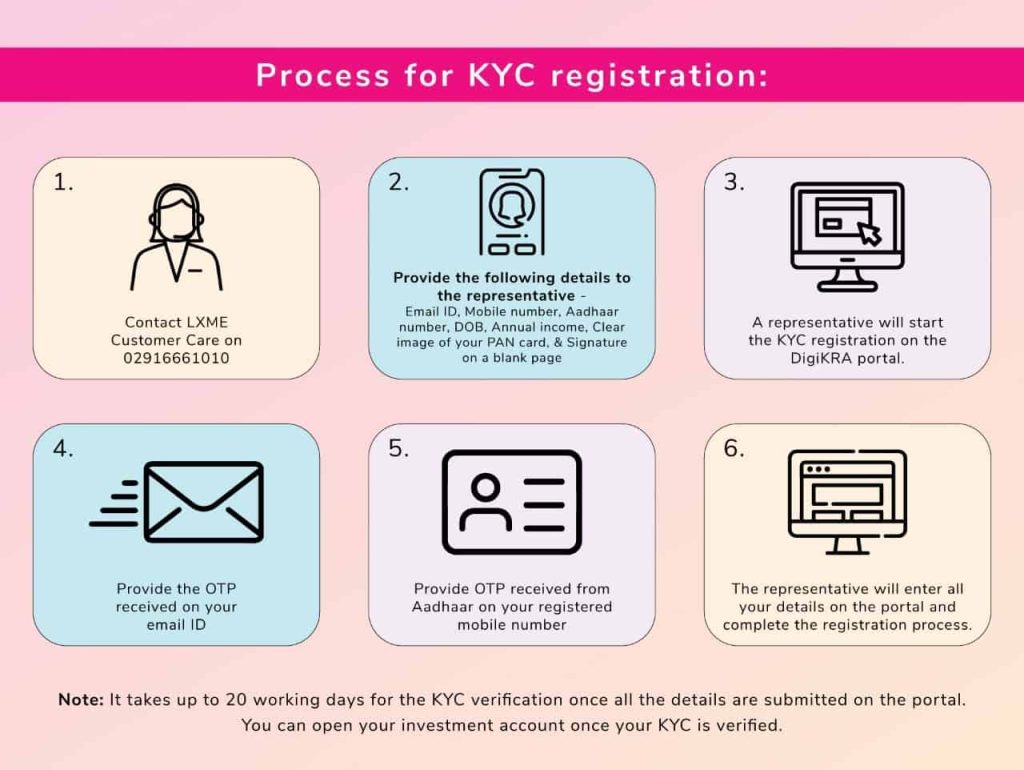

If you are not KYC compliant, here are the steps you can follow to complete your KYC registration:

- Contact LXME Customer Care on 02916661010

- A representative will start the KYC registration process on your behalf on the DigiKRA portal.

- Provide the following details to the representative-

Email ID, mobile number, Aadhaar number, date of birth, annual income, clear image of your PAN card, and signature on a blank page - The representative will sign you up on the DigiKRA portal for KYC verification using your email ID and mobile number. Provide the OTP received on your email ID.

- Provide OTP received from Aadhaar on your registered mobile number

- The representative will enter all your details on the portal and complete the registration process.

Note: It takes up to 20 working days for the KYC verification once all the details are submitted on the portal. You can open your investment account once your KYC is verified.

What is the process for opening an investment account on the LXME App?

Once you have completed the KYC verification process, all you need to do is follow these 10 steps to start your investments with LXME:

- Open the My Money tab on the LXME App and select your investment plan

- Enter your investment amount & duration.

- Click on invest now.

- Enter your PAN and date of birth on the Investment Ready page

- Verify your KYC details & click on continue

- Enter FATCA details

- Enter Nominee details (optional)

- Enter bank details and click on continue

- Upload the documents- Image of signature and cancelled cheque

- Review details and click on submit

- Start investing!

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Career July 25, 2024

How to Start and Grow Your Own Business

It’s both exciting and hard to grow and start a business. You need to have a plan and a strategy, and you need to stick to it to start your own business. There are some steps you must take before you can start your own tech, retail, or consulting business, so let’s see how to … How to Start and Grow Your Own Business

Career Lifestyle July 1, 2024

Steps to Prevent or Handle Workplace Harassment

Harassment at workplace comes as a very big issue. It can be defined as threatening behaviour by anyone at the workplace which can include insults, explicit messages, threats, bogus rumors, and offensive displays among other things. It can affect mental & physical health along with work performance. Cases of workplace harassment seem to be only … Steps to Prevent or Handle Workplace Harassment

Career June 24, 2024

Active Income vs Passive Income: Know the Difference

Life is about living and not just barely surviving from paycheck to paycheck. We all want financial freedom, right? To live life on our own terms, without worrying about making ends meet. We do too. Let’s talk about different types of income and the difference between active income and passive income. Believe it or not, … Active Income vs Passive Income: Know the Difference