Are you a Newbie in the financial world and want answers to the basic Qs on National Pension Scheme? Here you go!

What is NPS?

National Pension Scheme (NPS) is a pension cum investment scheme launched by the Government of India to provide security at the time of retirement to Citizens of India. It brings an attractive long-term saving avenue to effectively plan your retirement through investing in different asset classes available under NPS. The Scheme is regulated by Pension Fund Regulatory and Development Authority (PFRDA).

What is the eligibility to invest in NPS?

Any Indian Citizen in the age group 18-70 can open an NPS Account

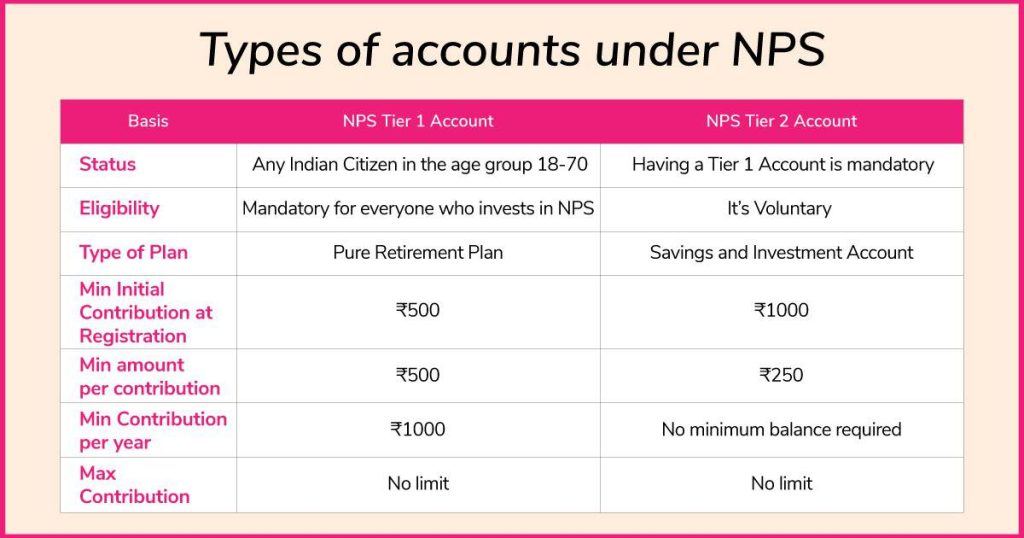

What are the types of accounts available under NPS?

Under NPS, there are 2 types of accounts available: Tier 1 and Tier 2 Account

Who should invest in NPS?

NPS can be ideal for someone who is looking for:

– A low-cost product

– Tax benefits for Individuals, Employees, and Employers

– Attractive market-linked returns

– Professional management by experienced Pension Funds

– Investing for a long-term period considering NPS(Tier 1) has a lock-in and needs regular income during the post-retirement period

– Flexibility in terms of selecting an asset allocation

How and where can I open an NPS account?

For all citizens and corporates wishing to provide this facility to their employees, NPS is distributed through various authorized Points of Presence (POP’s) and currently, almost all the banks (both private and public sector) are enrolled to act as Point of Presence (POP) apart from several other financial institutions. To invest in NPS, you can open an account with a Point of Presence (POP) or online through the eNPS platform.

You can open an NPS account online through eNPS if you have-

(i) Aadhaar Card, or

(ii) PAN card with Savings account

Website www.npstrust.org.in

Can NRIs open an NPS Account?

Yes, NRIs can invest in NPS. Also, Overseas Citizens of India (OCI) can enroll in NPS and they will be considered at par with non-resident Indians (NRIs).

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Insurance Retirement July 29, 2024

What are Annuities & How They Work

Aisha: Mansi, I’ve been hearing a lot about annuities lately, but I’m still not sure if they’re right for me. Can you shed some light on them? Mansi: Of course, Aisha. Annuities are essentially insurance products that provide a steady income stream, typically for retirement. You pay a lump sum or make periodic payments, and … What are Annuities & How They Work

Money Hacks Retirement

Financial Mistakes to Avoid: Secure Your Future by Avoiding These

Managing your money properly is important if you want to be safe and successful with your money. Still, a lot of people fall into old habits that can stop their money from growing. Here are the biggest money mistakes you should not make in 2024. This will help you keep your finances in good shape. … Financial Mistakes to Avoid: Secure Your Future by Avoiding These

Retirement

Retirement Planning: How to Plan for a Retirement

Mansi, a 30-year-old graphic designer, hasn’t started her retirement planning yet. After using Lxme’s eye-opening Retirement Calculator, she realized she needs a whooping 8.84 crores when she retires! She immediately starts an SIP of Rs, 15,922. She recommends the calculator to her 25-year-old sister who needs the same amount at the time of retirement but … Retirement Planning: How to Plan for a Retirement