New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Money Hacks May 21, 2025

How to Apply for Mahtari Vandana Yojana: Step-by-Step Process

The Mahtari Vandana Yojana launched by the Chhattisgarh government aims to promote the economic self-reliance of women in the state while ensuring continuous improvement in their health and nutrition levels. It seeks to strengthen their decisive role within the family, remove discrimination and inequality, and address the lack of awareness about women’s rights in society. … How to Apply for Mahtari Vandana Yojana: Step-by-Step Process

Tax May 15, 2025

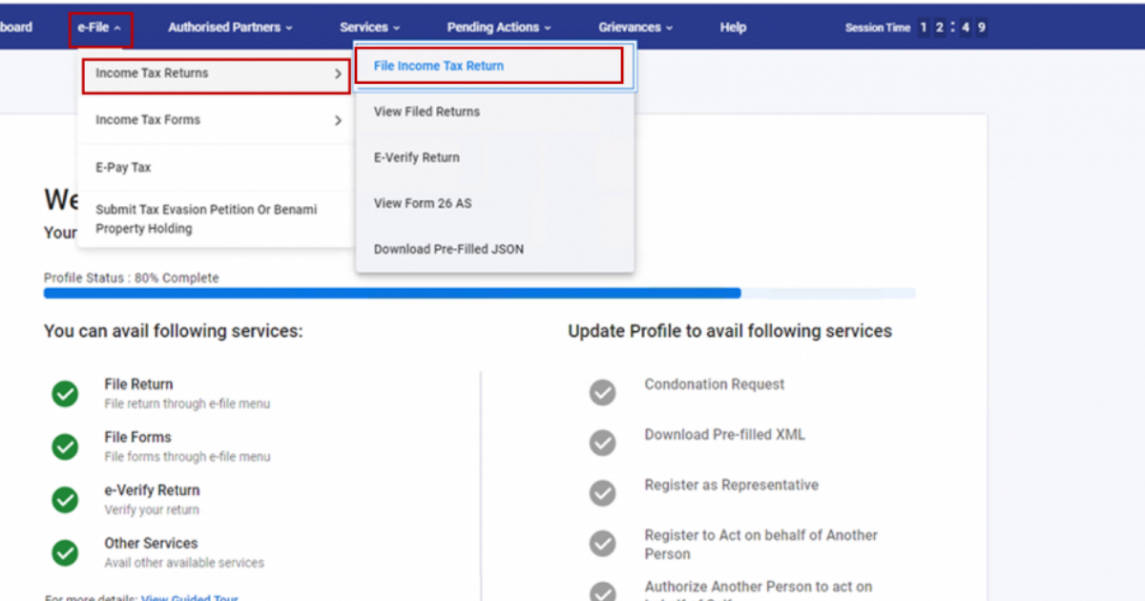

Tips to Pay Advance Tax Online Easily

If you’re a working woman—freelancing, running a small business, earning rent or interest income—you might have heard the term Advance Tax and wondered, “Is this something I need to pay?” Well, if your tax dues for the financial year exceed ₹10,000, the answer is yes. But don’t worry! In this guide we will take you … Tips to Pay Advance Tax Online Easily

Tax April 22, 2025

Tax Evasion vs. Tax Avoidance: What’s the Difference?

Let’s be real—when it comes to taxes, most of us just want to pay what’s fair and move on. But in the name of saving money, people sometimes take different routes—some smart, others… not so much. That’s where all the confusion between “tax avoidance” and “tax evasion” begins. Both try to cut down how much … Tax Evasion vs. Tax Avoidance: What’s the Difference?