How To Make 1 Crore In 15 Years: Shweta and Seema’s Financial Journey

Shweta: I wish I was a Millionaire. I could have crores of rupees at my fingertips, and I could do whatever I want.

Seema: Agreed we could have had so much fun.

Shweta: but we can’t. There is no way we can earn that much with our salaried income.

Seema: That isn’t true. We can also have crores of rupees by investing smartly.

Shweta: I don’t believe it. How is that possible?

Seema: Well, it is quite possible and all it asks for is some patience, dedication, and consistency.

Shweta: That sounds interesting. Please tell me more.

Seema: There are different ways to invest over a period of time to achieve your goals and targets. One such way is the 15-15-15 rule to accumulate a corpus of 1 crore. you can achieve this by being dedicated, consistent, and patient towards investing.

Shweta: If these things can get me 1 crore, I am ready to start with this for sure.

Seema: Okay, let me explain this rule to you in detail, what is the 15-15-15 Rule? How To Make 1 Crore In 15 Years

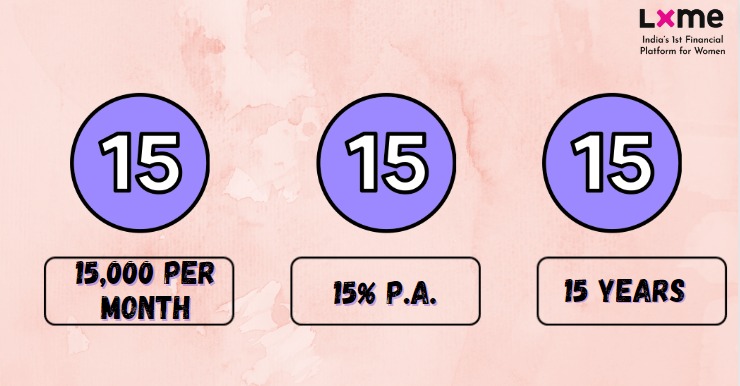

What is the 15-15-15 Rule?

– This is one of the ways that help you target a corpus of 1 Crore at the end of your investment tenure. Under this rule, the first 15 stands for the monthly investment that you need to make. That is, your monthly SIP amount will be Rs. 15,000.

– The second one stands for your investment tenure of 15 years i.e., to achieve the mentioned goal of 1 crore, you need to invest 15000 every month for 15 years.

– And the last one stands for 15% which is you need to invest the mentioned amount for the said tenure in an investment instrument that will target an average of 15% returns per annum. and that is how to make 1 crore in 15 years. Quiet, easy, right?

Seema: Now, in your mind, you might have a question about where to invest in order to get a 15% return p.a. right?

Shweta: Yes, the exact question came to my mind!

Seema: Yeah! I can read your mind?

Where to invest?

As we have seen earlier, we need to earn 15% p.a. on average so, in order to achieve that you need to invest in equity-related instruments as they target returns around 12%-15% p.a. in the longer term.

Then what are the ways to invest in equity-related investment instruments?

You can invest through mutual funds or directly. Mutual funds are one of the investment instruments through which you can get the benefit of professional fund management at a minimal cost. And you can start your investments in mutual funds with as low amount as Rs.100 and get the optimum benefit of diversification. As mutual funds are professionally managed by fund managers any common person who doesn’t have much knowledge can also invest in the same.

While investing in equity directly needs adequate knowledge and analytical skills in order to invest in the right stock and also time to track the market.

Equity mutual funds are a type of investment fund that pools money from multiple investors to buy stocks (shares) in various companies. When you invest in an equity mutual fund, you essentially own a portion of the entire portfolio of stocks held by the fund.

The value of your investment in the fund grows based on the performance of the underlying stocks held by the fund. Overall, equity mutual funds can be a good option for investors looking to participate in the stock market and potentially earn inflation-beating returns over time.

However, in India, there are more than 2500 mutual fund schemes, and it might be difficult for a common person to choose the best-suited mutual fund for themselves. Don’t worry LXME’s got you covered!

The LXME’s research team spends 1400 hours researching and curating the best-suited mutual fund baskets for the investors

You can visit the INVEST Tab and check out LXME’s Equity portfolios which are diversified, well-researched, and curated by experts where you can start your investments with just Rs.100.

Note: Mutual fund investments are subject to market risk, read all scheme-related documents carefully.

One should invest in equity mutual funds for the long term as the markets are volatile in the short term.

Related Post: – How to Save Money Each Month: 23 Tips for Saving in 2023

FAQS : Frequently Asked Questions

1. How can I make 1 crore in 10 years?

– Consider aggressive investment options with higher returns.

– Invest a substantial amount consistently.

– Aim for investments with an average annual return of around 15% or higher.

2. How much to invest in SIP to get 1 crore in 15 years?

The investment plan for 1 crore via SIP in 15 years should have these steps:

– Calculate the required SIP amount based on expected returns.

– Assuming a 15% annual return, you’d need to invest approximately Rs. 27,000 per month to reach 1 crore in 15 years.

3. How to get 1 crore in 20 years?

The investment plan for 1 crore in 20 years should have these steps:

– Maintain a disciplined investment approach.

– Invest regularly in diversified assets.

– Aim for an average annual return of around 12-15%.

– Adjust your monthly investment based on your expected return rate.

4. How can you become a crorepati in 15 years?

By consistently investing in a well-planned financial portfolio, leveraging high-return instruments like SIPs, and maintaining disciplined financial habits. The easiest way is to follow the 15 * 15 * 15 rule and invest carefully.

5. What is the 15 * 15 * 15 rule in mutual funds?

The rule talks about investing 15,000 per month with an interest rate of 15% for 15 years. This is the golden investment plan for 1 crore in 15 years.

Conclusion

To summarize what we learned today, by simply investing 15000 every month for 15 years in Equity-based mutual funds that target a return of 15% p.a., you can aim at becoming a crorepati at the end of your investment horizon. Be consistent, Stay invested and by investing dedicatedly.

Share this blog with your family and friends if you find it insightful!!

Download the LXME app now to start investing !

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Mutual Funds July 1, 2024

Shedding Light on Your Money Matters: Mutual Funds vs Index Funds

Conquering your financial goals takes knowledge and the right tools. At LXME, we empower women to take control of their money with online SIP investments. Today, we’ll delve into the world of mutual funds and index funds, two popular investment options. Understanding the difference between mutual fund and index fund will equip you to make … Shedding Light on Your Money Matters: Mutual Funds vs Index Funds

Mutual Funds

Conquer Your Future: Best SIP Plans for 30 Years and Building Financial Freedom with LXME

At LXME, we empower women to take control of their finances and achieve financial freedom. We understand the unique challenges women face when it comes to money matters, and that’s why we’ve built a safe and supportive investment platform designed exclusively catering to investment for women. But financial freedom doesn’t happen overnight, it requires a … Conquer Your Future: Best SIP Plans for 30 Years and Building Financial Freedom with LXME

Money Hacks Mutual Funds June 27, 2024

Navigating the Best Time to Buy Shares for Long-Term Growth

In the dynamic world of stock markets, strategic timing can be a game-changer for long-term investors. Our comprehensive blog, “Trying to Time Investments? Here Are Some Tips,” available on LXME, offers valuable insights into mastering the art of timing in stock investments. Uncover tips and strategies to identify the opportune moments to buy shares for … Navigating the Best Time to Buy Shares for Long-Term Growth