Investing is essential to achieve your goals. It is the only way to make your future better.

Dreaming of buying a car in the next 2 years or a house in the next 5 years? Wanting to have your dream wedding or starting that side hustle? Dreaming of your business or your retirement?

We often ask ourselves when it would be the best time to start investing. Should we wait for that increment or often think, “baad mein dekh lenge.” Well, the best time to start investing is NOW! (Yes, right NOW!). Investing early can make an enormous difference in your financial journey.

This blog will guide you on how to turn your dreams into reality with investment tips and how you can start investing for the future!

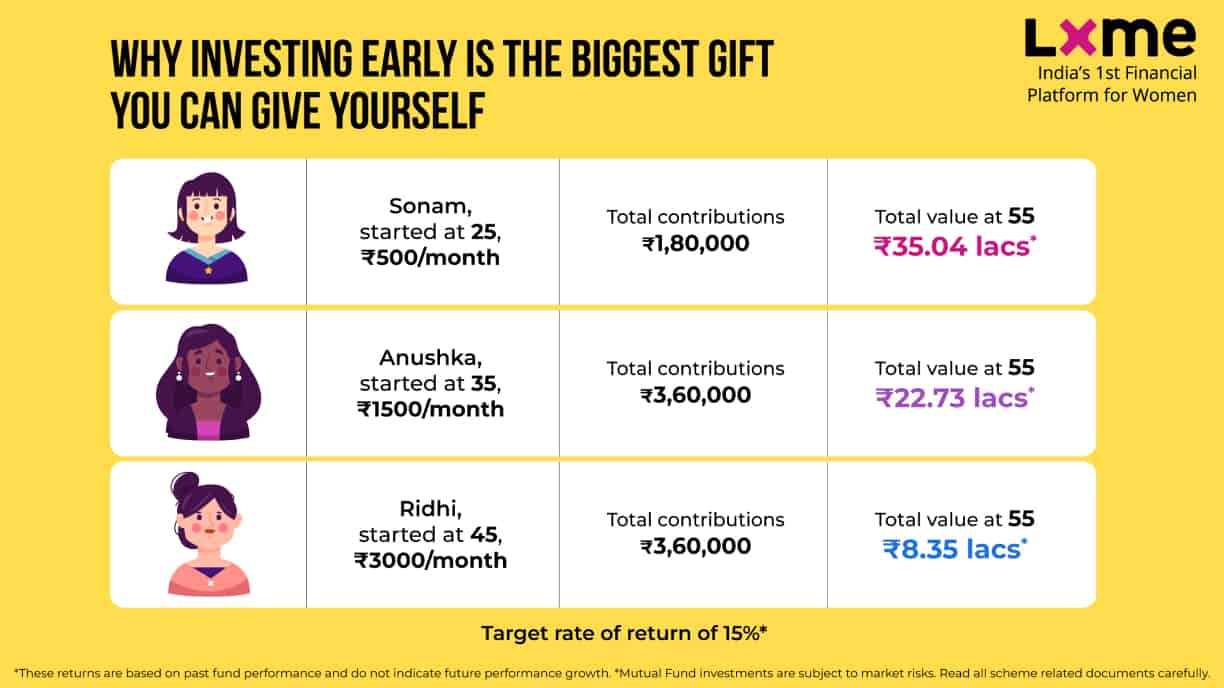

Let us take a look at an example:

The ultimate goal is to not how much you invest but how smartly you invest. In the example above, Sonam started investing with just Rs. 500/- a month and ended up with a corpus of Rs. 35.04 lacs compared to Ridhi, who began investing at the age of 45 with Rs. 3000/- a month. Ridhi ended up with a corpus of Rs. 8.35 lacs.

Here are 5 things you should start investing for:

1. Compounding – Time plays a critical role in investing your money! It is not how much you save and invest but for how long you invest. The secret is the ‘power of compounding.’ Compounding can turn a small sum of money into comfortable nests. Hence, it is essential to start investing early, even if you start with a low amount. You can start investing today with as low as Rs.100/-in LXME Rs 100/- Debt and Equity Plan.

2. Security – It is essential to save for ‘rainy days.’ This sum of money is a safety net which is helpful during any unplanned expenses or unforeseen circumstances. It could be home/car repairs, medical emergencies or job layoffs. It creates financial security for yourself as well as your family in situations. Generally, an Emergency fund should have 6-8 months’ worth of expenses. However, it is always beneficial to keep more. Instead of letting the money sit in your savings bank account, it is better to invest it.

3. Retirement – Do you dream of early retirement and living comfortably with complete financial freedom? Your dreams will turn into reality if you start working for them! Check out LXME’s Retirement Calculator to understand how much corpus you need when you retire and more investment tips!

4. Child Education – Education costs have gone bizarre! Instead of just building castles in the air, it is time to start planning and investing in your child’s education. Start planning early so you don’t have to worry about it when the time comes. It will help you plan your finances accordingly. Check out LXME’s Child Education Calculator and Portfolio, and start investing for the future.

5. Goals –Now think about the other goals you are saving for! Do you want to travel the world, buy your own home, buy that designer bag or set up a business? To fulfil your goals, you will have to understand how much money you need for each of them and when you want to achieve them! By using the LXME’s Goal Calculator,you will be able to know how much you need to invest! Start investing today for a better future.

FAQs: Investment Tips

What does investing in your future mean to you?

Investing for the future would help you make strategic choices today to secure a better tomorrow. It involves allocating resources wisely, considering long-term goals, and staying informed with investment tips.

How does investing in our future help?

Investing for the future will help you create financial stability, enable personal growth, and build a foundation for a comfortable life. It maximizes opportunities and safeguards against uncertainties, emphasizing the importance of smart choices. Start investing today.

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Lifestyle July 25, 2024

Tips to Save Money on Utility Bills

Managing a home isn’t as easy as it seems. From multi-tasking to micromanaging every single thing along with finding ways to save money, home management should be one of the most difficult jobs out there. Most of the time, women are in charge of budgeting & spending money on household needs and they benefit greatly … Tips to Save Money on Utility Bills

Lifestyle

Time Management Tips for Women: Strategies for Success

If you can manage your time efficiently, you have won in life! Do you agree with this, ladies? Getting the most amount of work done in the least amount of time would mean good time management for working women and women in general. Here are some common questions that will be answered regarding time management … Time Management Tips for Women: Strategies for Success

Lifestyle July 23, 2024

6 Healthy Habits Every Woman Should Follow

“We are what we do. Excellence, then, is not an act, but a habit.” Habits can either make you or break you. Due to the fast-paced nature of modern life, it is important to develop healthy habits for women that will help them live a long and happy life. A woman should not only be … 6 Healthy Habits Every Woman Should Follow