In the ever-evolving realm of taxation, the choice between the old and new tax regime for 2023 is a pivotal decision. Our insightful blog at LXME delves into the intricacies of the Budget 2023, shedding light on the critical factors influencing your choice between the old and new tax frameworks. As we explore the nuances, the keyword “old vs new tax regime 2023” takes center stage, guiding you through this crucial decision-making process. Stay informed, make confident choices – your financial future awaits. Explore the blog here.

Trupti has a serious question. Her HR has asked about which tax regime she wants to choose and she is confused because she’s not aware of the details of the tax regimes.

When she researched she got to know that in the New tax regime, she won’t have to pay tax if her annual income is below ₹7 lakh and if she opts for the old tax regime then she can claim tax deductions under various sections by investing in tax-deductible instruments.

But were these the only things to consider while choosing a specific tax regime?

No! There are multiple factors she should consider before deciding on which regime to go for. Let’s help out Trupti with her decision.

Which Tax Regime should one choose?

With the recent changes in the tax regime, taxpayers are in a state of confusion on whether to choose the old or the new tax regime. Let’s decode a way how one can select the regime that best suits them.

Both regimes have their own pros and cons. One should do a comparative evaluation of their taxes under both regimes and then select the one that is beneficial to them.

Following are the factors that a person should consider while selecting the tax regime

- Income level

- Investments opted for

- Deductions

- Exemptions

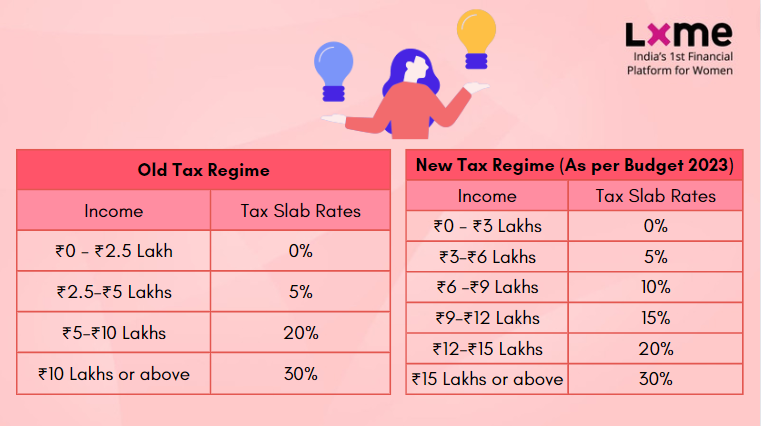

In the New Tax Regime the Government has increased the tax slabs and the entire income will be tax-free if the income is under ₹7 lakh. Whereas, in the Old Tax Regime, there are fewer tax slabs and one has to pay no tax if their taxable income falls under ₹5 lakh.

Let’s have a look at Old and New tax slabs –

In Budget 2023, the new tax regime has brought the following changes that one should consider –

- Simplified tax slabs – The Government has increased the tax slabs to six in the New Tax Regime and with comparatively lower rates for those who fall under ₹15 lakh tax bracket.

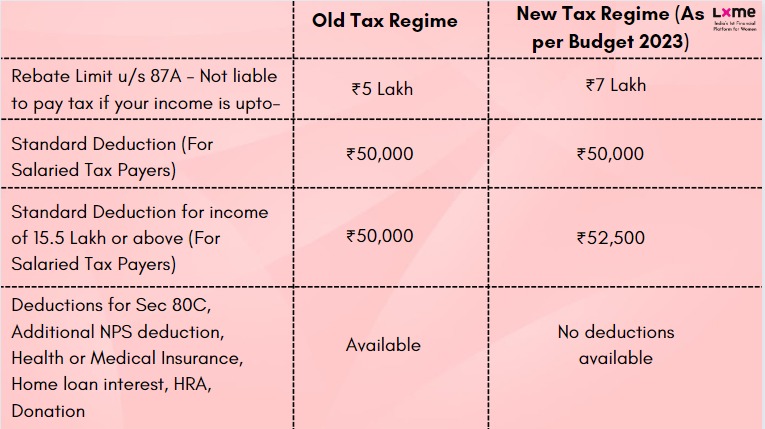

- Increased Tax Rebate limit – Under Sec 87A of the Income Tax Act, the total tax rebate has been increased from ₹5 lakh to ₹7 lakh in the New Tax regime, which means a person is not liable to pay taxes if their income is below or equal to ₹7 lakh.

- No choice of opting for deductions and exemptions – Various exemptions and deductions like House Rent Allowance (HRA), Leave Travel Allowance (LTA), Sec 80C, Sec 80D, and many more cannot be claimed under the New Tax Regime.

- Default Tax Regime – This regime will be considered as a default one and if someone wants to go for the old regime then one can certainly opt for the same.

- Shift from Old to New Tax Regime – People earning salaried income and no business income can shift from Old Tax Regime to New Tax Regime or vice versa once a year. However, individuals earning Business Income can shift only once.

Note – These changes will be applicable from the this financial year i.e FY 2023 – 24

Comparative analysis –

Example:

Let’s look at Trupti’s example and calculate her tax liability in both regimes.

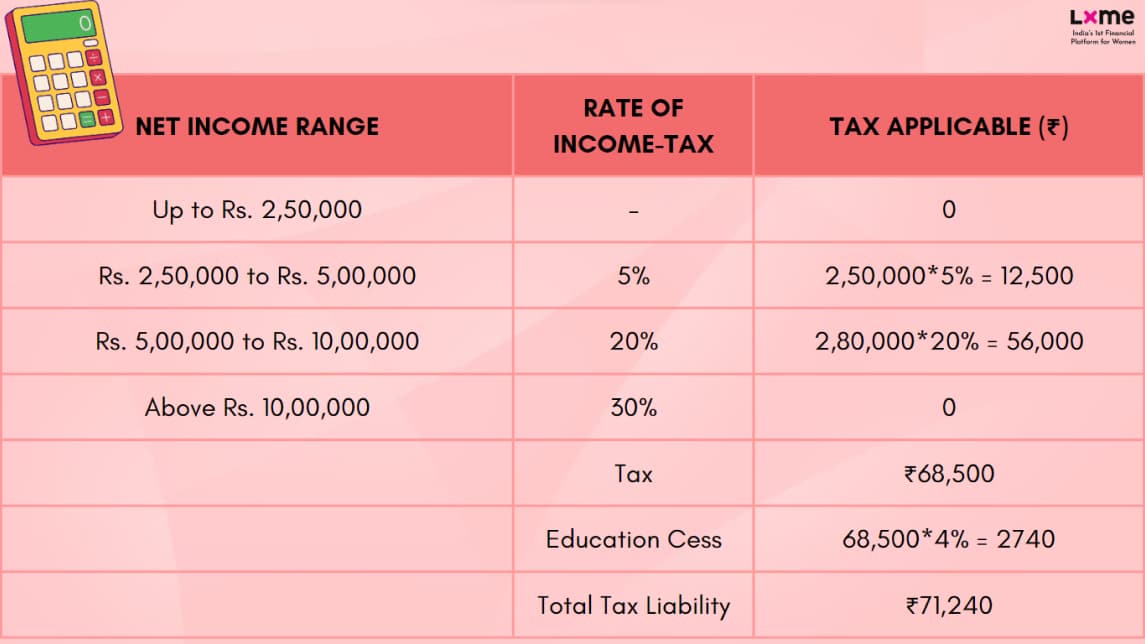

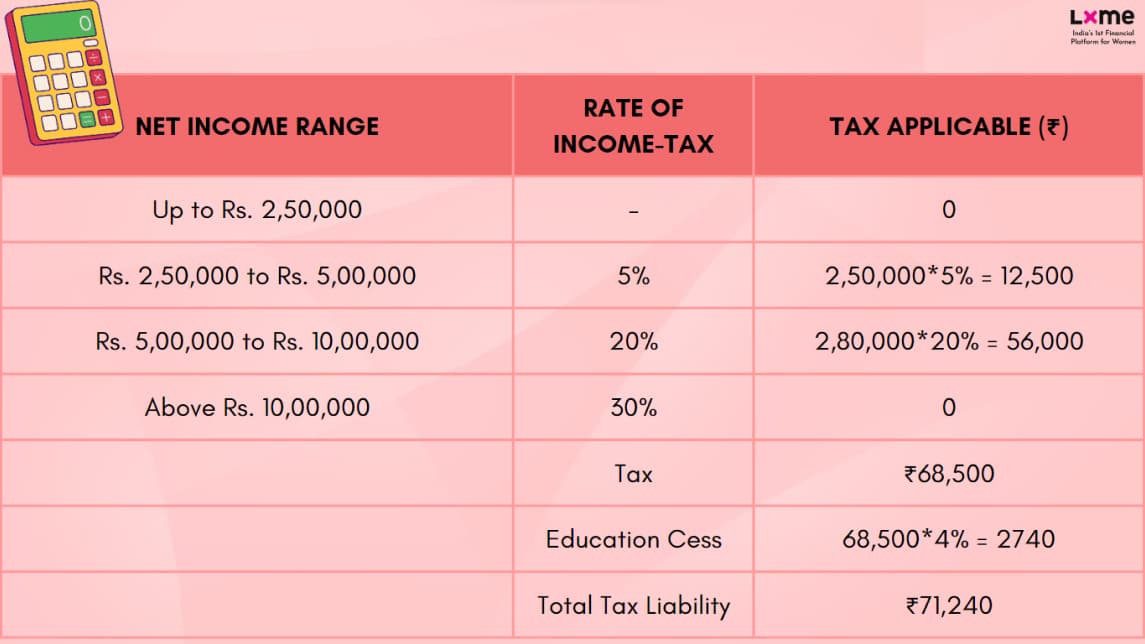

Trupti is working as a Software Developer at ABC Co. with an annual package of ₹10 lakhs. She has made an investment of ₹1,50,000 under section 80C and she has health insurance premium of ₹20,000 which she claimed under section 80D. Following is her tax liability calculation under both regimes –

As we can clearly see that for Trupti, selecting the New Tax Regime is beneficial.

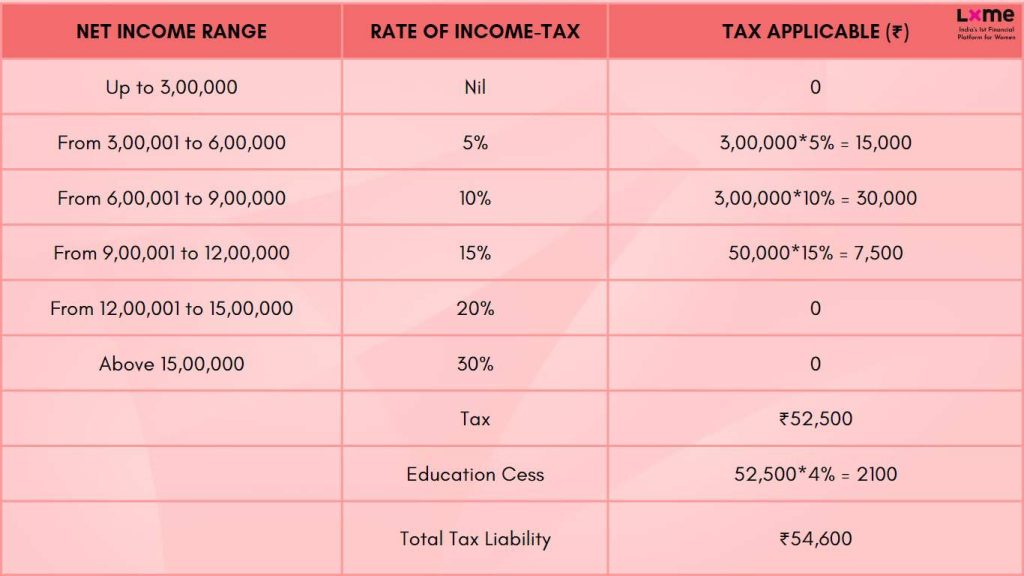

Let’s checkout a detailed calculation of her tax liability –

For Old regime, the calculation is as follows –

For New regime, the calculation is as follows –

If you opt for the old tax regime, then you can invest in Equity Linked Savings Scheme (ELSS) which offers you a deduction under section 80C up to the limit of ₹1.5 lakh. By investing in ELSS funds you get double benefit of getting inflation-beating returns along with tax benefits.

You can check out LXME’s Tax Saving Portfolio which further invests in ELSS funds which has a lock-in period of 3 years and offers the targeted return of 16% p.a. (market-linked). This fund is diversified, well-researched, and curated by experts.

Bottom-line:

To select the best regime that suits your requirements, one should always consider doing a comparative calculation of their taxes under both regimes and accordingly select the one where their tax liability would be lower. They can continue with the same regime unless there is any change like home loans, etc.

As everyone has their own set of deductions and exemptions, they should compare their tax liability under both regimes and then certainly make the best decision for themselves.

“Paying tax is not a burden, it’s a responsibility.”

-Chris Matthews

Share this blog with your friends and family if you find it insightful!!

Download the LXME app now to start investing! Happy Investing!

FAQs Around Old vs New Tax Regime 2023

Which regime is better for income tax 2023?

Old Regime Advantages:

Tailored Deductions: Offers various deductions, beneficial for specific taxpayers.

Familiarity: Well-established, widely understood by taxpayers.

New Regime Highlights:

Simplicity: Streamlined structure with reduced complexity.

Lower Rates: Competitive tax rates, potentially leading to lower tax liability.

Will income tax change in 2023 for the old regime?

Status Quo for Old Regime: No Compulsory Change: Taxpayers under the old regime won’t face mandatory shifts.

Deduction Flexibility: Continue enjoying existing deductions.

For a detailed exploration, visit LXME’s Blog. Make an informed decision aligned with your financial goals.

To stay connected with LXME and access inspiring content, follow us on Instagram and subscribe to our YouTube channel.

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Saving October 21, 2024

How to apply for Nari Sashaktikaran Yojana Online?

Neha: Hey Riya, have you heard about the Nari Shashaktikaran Yojana? It’s supposed to empower women with financial help! Riya: Really? Sounds interesting! But, how do we even apply for that online? Neha: I was just about to look it up. Let’s find out together, I found a blog on the same In today’s world, … How to apply for Nari Sashaktikaran Yojana Online?

Tax August 26, 2024

Best Tax Saving Tips for Women Entrepreneurs

Riya: Hey, Neha! I’ve been stressing over taxes. Running my own business is rewarding, but the taxes are overwhelming. Neha: I totally get it, Riya! I’ve been there too. But guess what? I found some amazing tax-saving tips specifically for women entrepreneurs like us. Riya: Really? That sounds exactly like what I need! Tell me … Best Tax Saving Tips for Women Entrepreneurs

Mutual Funds Saving July 29, 2024

7 Reasons Women Should Have Emergency Savings

Ladies, here’s a questionnaire for you: What would you do in case of a medical emergency? Ask for money from friends or put it on the credit card? What would you do if your company didn’t give you a maternity leave? Leave the job or keep working & stressing? What would you do if your … 7 Reasons Women Should Have Emergency Savings