Introduction:

In today’s fast-paced world, investing in equity has become an essential part of financial planning. Equity investments offer the potential for significant long-term returns that can play an important role in building wealth. But still, many are unaware of how to start investing in equity or even how to invest in the stock market or share market.

However, many women have the perception that investing in equity requires a large amount of money. Let’s bust this myth! In this blog, we’ll show you how to invest in equity with just Rs. 100, a guide to equity investment for beginners.

What is Equity and why is it important?

Let’s understand this in a really simple language. Equity, also known as stocks or shares, represents ownership in a company. When you own shares of a company, you hold a portion of that company’s equity. It is essential because it can provide you with an opportunity to build wealth over time, provide inflation-beating returns, and aim at offering higher returns than other savings/investment options.

How does Equity impact your portfolio?

Let’s understand this in a really simple language. Equity, also known as stocks or shares, represents ownership in a company. First, let us understand how stock market works. When you own shares of a company, you hold a portion of that company’s equity. It is essential because it can provide you with an opportunity to build wealth over time, provide inflation-beating returns, and aim at offering higher returns than other savings/investment options.

How does Equity impact your portfolio?

Equity investments can significantly impact your portfolio with their potential for high long-term returns. However, they come with market volatility and risk. To invest wisely, understand your financial goals and risk tolerance. Keep in mind that equity is suitable for goals beyond 3 years, as it provides inflation-beating returns in the long-term but can be volatile in the short term.

How to invest in Equity with just ₹100?

You can initiate your journey into Equity investments with just ₹100 by investing in Equity Mutual Funds. Equity mutual funds are investment vehicles that pool money from multiple investors to buy a diversified portfolio of stocks, managed by professionals, with the aim of generating returns and potentially growing investors’ money. It is a great way to start small and earn inflation-beating returns.

Why is investing in Equity via Mutual funds better?

Investing in equity through mutual funds offers several advantages:

- Diversification: Mutual funds allow you to access a diversified portfolio of stocks. This reduces the risk associated with investing in individual stocks.

- Professional Management: Mutual funds are managed by experienced fund managers who make investment decisions based on their research and analysis.

- Liquidity: You can buy or sell mutual fund units on any business day, providing liquidity.

- Affordability: Mutual funds offer a cost-effective way to invest in equity, even with a small initial investment. You can start with as little as ₹100.

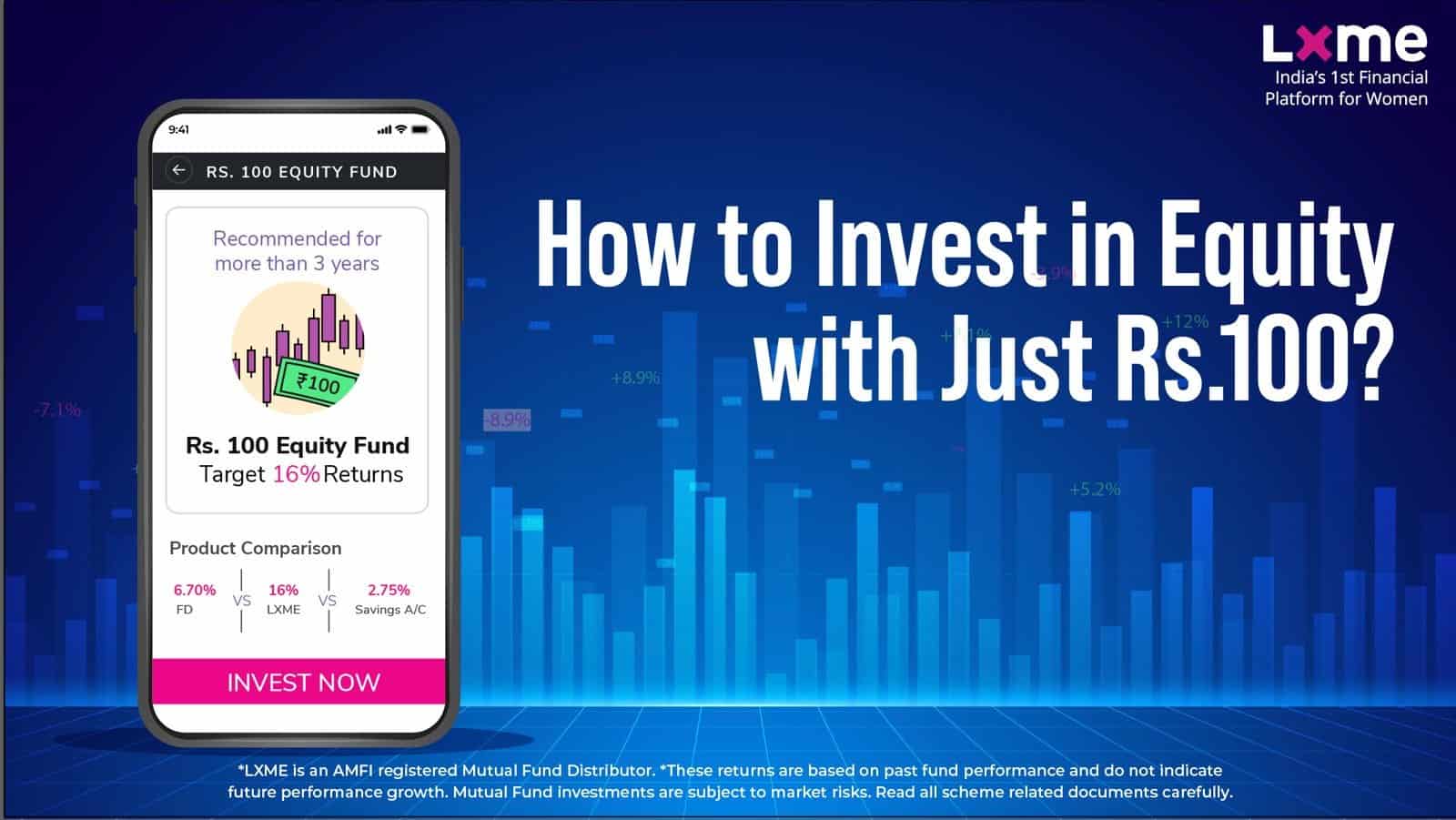

One such option for investing in equity with just ₹100 is LXME’s ₹100 Equity Fund. This fund is designed to cater to the needs of small investors who want to start their equity investment journey with a minimal amount.

Here are some key features and benefits of this fund:

Features of LXME’s ₹100 Equity Fund:

- LXME’s ₹100 equity fund invests majorly in Large cap and some portion in Mid and Small cap companies.

- The riskometer level of this fund is very high as the money is invested in Equity markets, which are volatile in the short run. Hence, it’s important for investors to have a long-term horizon to manage the risk.

- Best suited for long-term goals of 3+ years

- Targeted Rate of Return: 16%*p.a.

- Curated by experts!

Benefits of LXME’s ₹100 Equity Fund:

- Aims at earning inflation-beating returns.

- 2 modes of investments: SIP & Lump sum

- Minimum investment : SIP – ₹100, Lumpsum – ₹1000

- Regulated by AMFI(Association of Mutual Funds in India).

How much Equity should you have in your portfolio?

Let’s learn about the Equity investment strategies –

We will understand this with an example:

Ritika is 30 years old and wants to invest ₹1000 every month. Let’s see how she can diversify her money between 3 important asset classes Equity, Debt, and Gold.

By using the 100 – Age Asset Allocation thumb rule, (where 100 – Age = Percentage of Equity in your investments), 5-10% in Gold and the rest in Debt.

Equity investment = 100 – 30 = 70%. Therefore, 70% of ₹1000 = ₹700 she could invest in equity.

Gold investment = She decides to invest 10% of ₹1000 i.e. ₹100 in Gold.

Debt investment = ₹1000 – (investment in Equity + Gold) i.e ₹1000 – ₹800(₹700 +₹100) = ₹200, is what she decides to invest in Debt.

This is how, with just ₹1000, Ritika diversified her portfolio into Equity, Debt, and Gold, and she could access all these Asset Classes through Mutual Funds, making Investing simple and accessible.

(Note – This is just an example based on the thumb rule, it’s important to allocate money based on your financial goals and risk appetite_

Check out LXME’s ₹100 Equity, Debt, and Gold Fund and start your investments with just ₹100!!

Conclusion

Investing in equity with just ₹100 is not only possible but also a smart way to start building wealth for your future. Through mutual funds like LXME’s ₹100 Equity Fund, you can enjoy the benefits of professional management, diversification, and affordability.

Remember to align your investments with your financial goals and risk tolerance, and consider a long-term approach.

Start your equity investment journey today and watch your wealth grow over time.

Share this blog with your family and friends if you find it insightful!!

Download the LXME app for more such content!

1. Are Equity Mutual Funds regulated and secure?

Ans: Yes, Equity Mutual Funds are regulated by the Association of Mutual Funds in India (AMFI), providing investors with security and oversight.

2. What are the key benefits of investing in Equity Mutual Funds?

Ans. Investing in Equity Mutual Funds offers several benefits, including earning inflation-beating returns, professional management for optimal returns, liquidity, affordability (starting with ₹100), convenience and security, and transparency through regular updates and disclosures.

3. Is it OK to invest 100% in equity?

Ans. We should always invest according to our goals, considering our Risk appetite. Equity investment for beginners can use this simple Asset allocation rule i.e 100 – Age = % of equity in your portfolio to decide how much they want to allocate in Equity.

4. Can I invest with only 100 rupees?

You can start investing in the stock market with just 100 rupees. This can be accomplished using numerous platforms that support fractional investing, allowing you to purchase a portion of a stock with the necessary amount.

5. Which stock should I buy with 100 rupees?

For beginners in equity investment, conducting thorough research before selecting a stock is essential. The company’s financial health, growth prospects, and industry trends are all aspects to be considered.

6. Is it safe to invest in SIP?

Systematic Investment Plan (SIP) is generally considered a safer way to invest in the stock market, especially for beginners. SIPs consist of regularly investing a fixed quantity over time, facilitating rupee cost averaging. This strategy mitigates the impact of market volatility on your investments. Nevertheless, selecting SIPs should be guided by risk tolerance and financial objectives.

7. How to invest in the share market?

Investing in the share market involves opening a demat and trading account, researching stocks or funds, and placing buy orders through your brokerage. Awareness of market trends and company performance is paramount, as is contemplating a long-term investment strategy.

8. How stock market works?

The stock market is a platform where buyers and sellers trade shares of publicly listed companies. Various elements impact stock prices, including investor sentiment, economic conditions, and company performance. Acquiring knowledge of global events, conducting thorough investigations, and comprehending market dynamics are fundamental components for effectively navigating the stock market.

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Mutual Funds July 1, 2024

Shedding Light on Your Money Matters: Mutual Funds vs Index Funds

Conquering your financial goals takes knowledge and the right tools. At LXME, we empower women to take control of their money with online SIP investments. Today, we’ll delve into the world of mutual funds and index funds, two popular investment options. Understanding the difference between mutual fund and index fund will equip you to make … Shedding Light on Your Money Matters: Mutual Funds vs Index Funds

Mutual Funds

Conquer Your Future: Best SIP Plans for 30 Years and Building Financial Freedom with LXME

At LXME, we empower women to take control of their finances and achieve financial freedom. We understand the unique challenges women face when it comes to money matters, and that’s why we’ve built a safe and supportive investment platform designed exclusively catering to investment for women. But financial freedom doesn’t happen overnight, it requires a … Conquer Your Future: Best SIP Plans for 30 Years and Building Financial Freedom with LXME

Money Hacks Mutual Funds June 27, 2024

Navigating the Best Time to Buy Shares for Long-Term Growth

In the dynamic world of stock markets, strategic timing can be a game-changer for long-term investors. Our comprehensive blog, “Trying to Time Investments? Here Are Some Tips,” available on LXME, offers valuable insights into mastering the art of timing in stock investments. Uncover tips and strategies to identify the opportune moments to buy shares for … Navigating the Best Time to Buy Shares for Long-Term Growth