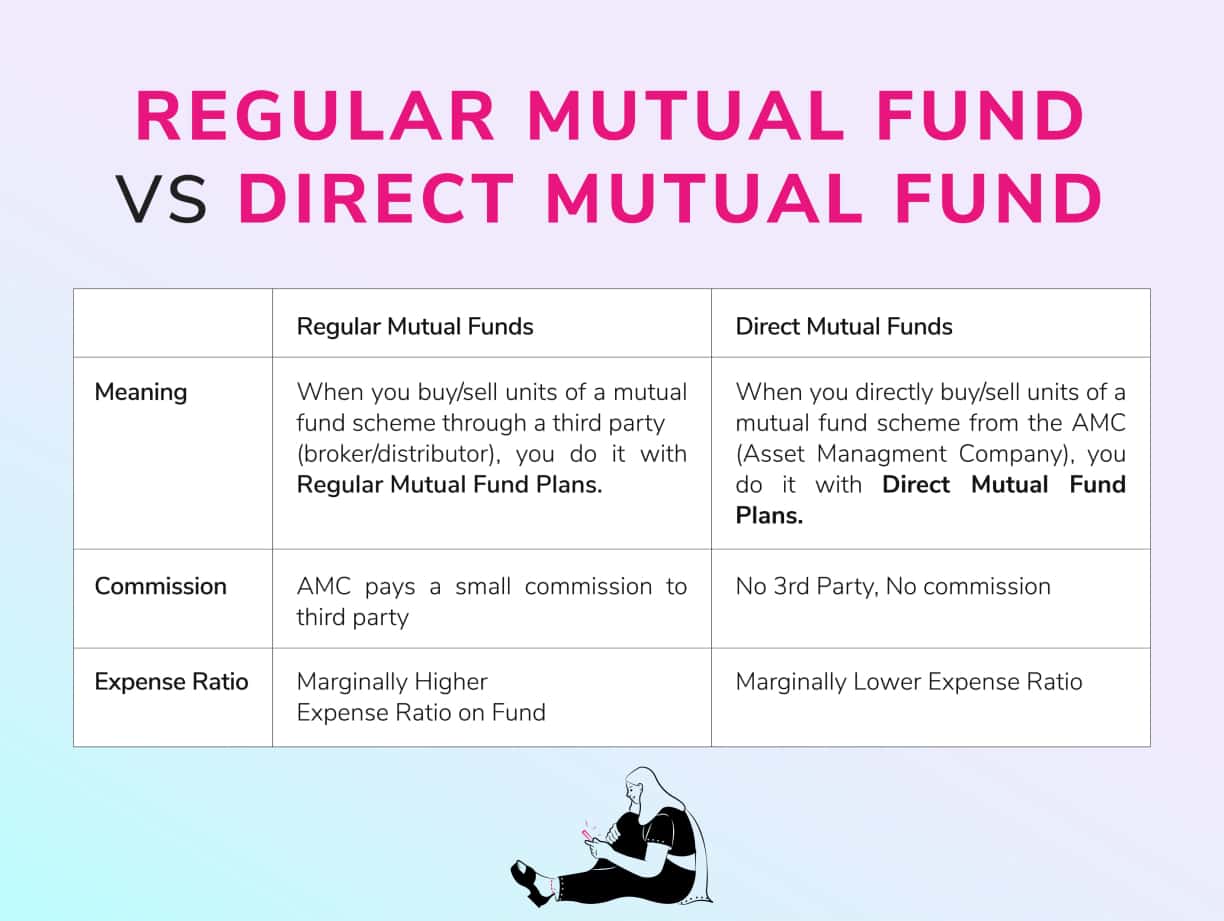

So what’s the buzz around Direct vs Regular Mutual Fund?

If you’re an investor or are thinking about investing in mutual funds, we bet you’ve been subjected to an overload of welcomed or unwelcomed, legit or unsolicited advice on direct and regular mutual funds. So, what’s going on?

Let’s understand this better

You’d think that a direct fund is right for you because you don’t have to pay a commission! But hold on, there’s got to be a catch right?

So ask yourself these 5 questions before you decide to SWITCH or invest in a Direct Mutual Fund

Do you understand the financial markets?

- Can you undertake technical & fundamental analysis of all funds you invest in?

- Can you make an investment decision without any guidance?

- Do you have the time to track the market?

- Are you willing to actively manage & rebalance your portfolio?

And all this amounts to a LOT of time. Are you ready to take on this responsibility and do you have the skill?

It may seem like Direct Mutual Funds can help you eliminate the third party commission charges, but we feel the need to tell you that although you will pay a small commission on a regular fund, the amount in question must be weighed against the expertise, guidance and convenience it offers.

So on 24th July, we hosted a LIVE with industry expert and LXME founder, Priti Rathi Gupta to discuss and get our questions clarified on Regular VS Direct Mutual Funds.

These are the key takeaways from that informative session: –

- For Regular Funds, the biggest asset is to have someone monitor your funds 24/7 giving you a constant edge in your investments. The guidance, expertise, and rebalancing come as part of a Regular Fund. Also in events like a market downfall, change in sectorial views, debt-equity ratio, and futuristic scenario, the fund manager steps in and guides the investor on the best possible outcome.

- Of course overall returns are very crucial when it comes to your investments but understanding the opportunity cost – The 1% cost of regular funds in return for a 2-3% cost on guided and monitored investments is important to take note.

- Direct Funds is not for all types of investors – An HNI investor who puts crores in Mutual Funds could consider Direct Plans however, even for that type of an investor, it’s important to constantly take out time to rebalance and scale the markets for best course of action which seems impossible.

- Before choosing a Regular VS Direct fund, it’s important to ask yourself these important questions.

What are the skills I have?

What are the returns I need?

And therefore, what is the best option for me between costs and returns.

If you found this helpful, share this blog with your friends and family!!

Download the LXME app now to start investing!

Related Article You May Like: – ELSS Tax Benefits: Understanding Tax Bachao, LXME Badhao

FAQs – Common Questions on Direct vs Regular Mutual Fund

Which mutual fund is better: direct or regular?

Answer: LXME recommends understanding your investment style. Direct funds suit DIY investors for lower costs. Regular funds, with advice, are suitable for those preferring guidance.

Which is better: direct or regular?

Answer: It depends on your preference. Direct funds offer lower costs but require self-management. Regular funds provide guidance but may have higher expenses.

Why are regular funds better than direct funds?

Answer: Regular funds offer professional advice, making them suitable for investors seeking guidance. Though with slightly higher costs, the expertise provided can outweigh the expenses.

To stay connected with LXME and access inspiring content, follow us on Instagram and subscribe to our YouTube channel.

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Mutual Funds July 1, 2024

Shedding Light on Your Money Matters: Mutual Funds vs Index Funds

Conquering your financial goals takes knowledge and the right tools. At LXME, we empower women to take control of their money with online SIP investments. Today, we’ll delve into the world of mutual funds and index funds, two popular investment options. Understanding the difference between mutual fund and index fund will equip you to make … Shedding Light on Your Money Matters: Mutual Funds vs Index Funds

Mutual Funds

Conquer Your Future: Best SIP Plans for 30 Years and Building Financial Freedom with LXME

At LXME, we empower women to take control of their finances and achieve financial freedom. We understand the unique challenges women face when it comes to money matters, and that’s why we’ve built a safe and supportive investment platform designed exclusively catering to investment for women. But financial freedom doesn’t happen overnight, it requires a … Conquer Your Future: Best SIP Plans for 30 Years and Building Financial Freedom with LXME

Money Hacks Mutual Funds June 27, 2024

Navigating the Best Time to Buy Shares for Long-Term Growth

In the dynamic world of stock markets, strategic timing can be a game-changer for long-term investors. Our comprehensive blog, “Trying to Time Investments? Here Are Some Tips,” available on LXME, offers valuable insights into mastering the art of timing in stock investments. Uncover tips and strategies to identify the opportune moments to buy shares for … Navigating the Best Time to Buy Shares for Long-Term Growth