The one thing everything money can buy has in common is the constant rise in their prices. But Inflation isn’t just what the government reports. Learn how Inflation really affects you.

Year after year prices rise, decreasing the purchasing value of our money, causing budget changes and reminiscences of the good old days a la “Rs.25,000 could buy a lot more than a smartphone!”

You must be thinking, okay, what’s new? It’s one of those facts of life you just have to accept and move on.

But we’re not happy about it and you shouldn’t be either.

How it Works

Our government measures the inflation rate by allocating a weight to each product category, as prices of different goods and services rise at different rates. The weights are allocated to each category on the basis of how much the government thinks the average population spends on it. Considering all the weights, the final inflation rate of the economy is calculated.

Seems fair, right? Not unless you spend more on food and beverages than you do on housing, health or education.

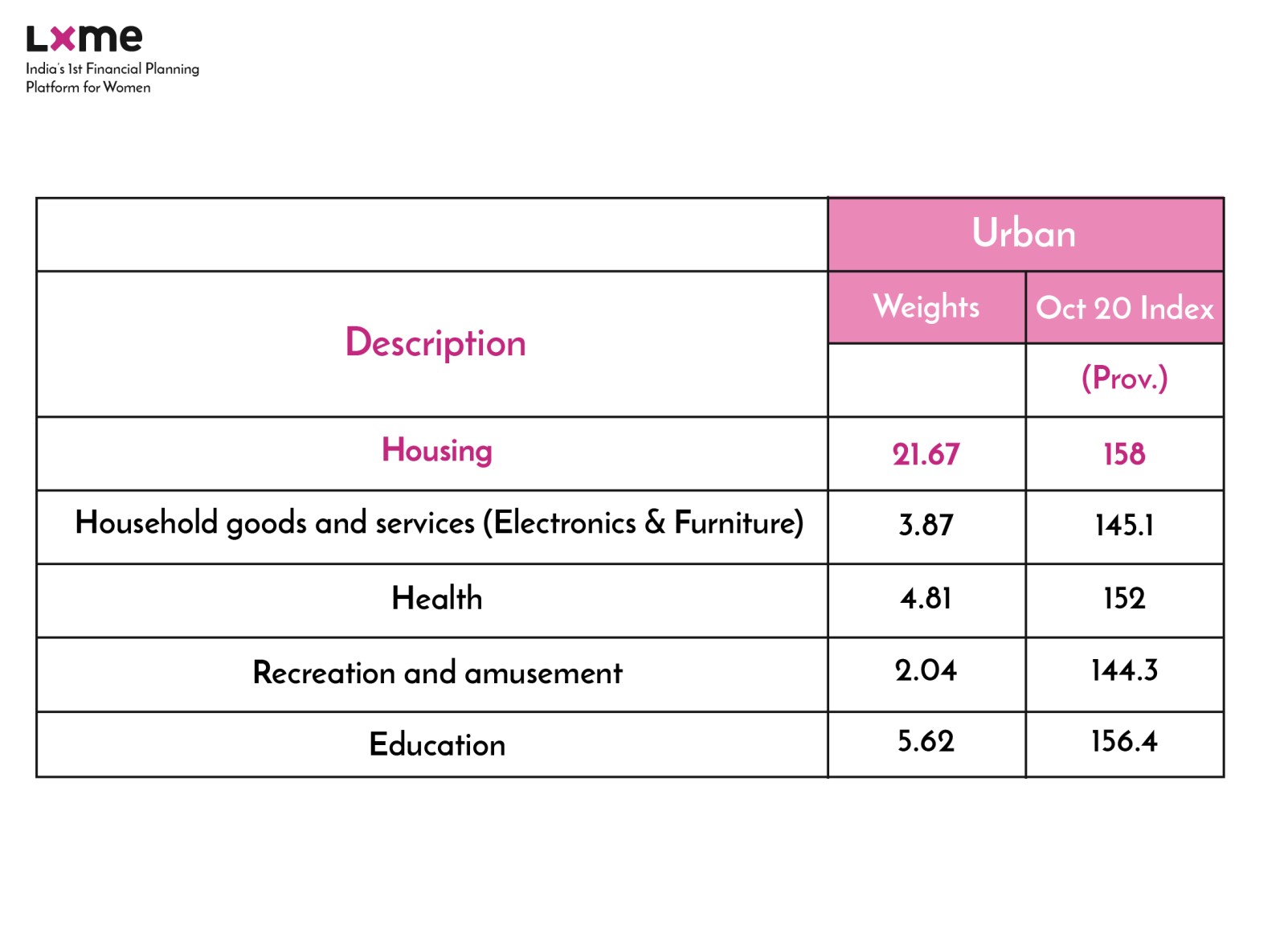

The highest weight, 32.69, has been allocated to the ‘Food and Beverages’ category as per the Government of India. This almost seems like a joke when compared to the weights provided to the expenditures that the average person actually incurs. Check out the list below:

What This Means for You

While the inflation rate for the economy may be 7.61%, the relevant inflation rate for you is a nightmarish 12%.

Now that fact’s sunk in, let’s get to know more about this beast called relevant inflation.

The thing about the inflation rate is that it’s much like a shoe size. It varies from person to person, and the way it is calculated in terms of an economy can be drastically different from how it weighs out for each individual. Just as our shoe size and shape depends on what our feet do, inflation relevant to us depends on what we spend on.

The relevant inflation rate of 12% is calculated considering the items that take up most of our earnings like housing, household goods and services, health, education, and recreation.

Don’t Bait it, Beat It

Be aware, and earn and save realistically. The rate of inflation calculated as per the averages of across the country’s disparate income and spending levels is not quite accurate for you.

The fact that the money you have in your wallet and bank account is steadily losing its value is one of the worst realizations to have. However, it’s one about which you can do something to counter.

Investments are a great way to balance out, and even overtake the reducing value of your money. Make your money grow with inflation-beating investments. Don’t let your hard-earned wealth slip through your fingers!

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Uncategorized May 17, 2023

LXME presents Housie Hungama

Get ready for an electrifying Housie experience with LXME! Our blog, “LXME Presents Housie Hungama,” is your ticket to a game night like no other. Discover game variations, tips for hosting the perfect Housie party, and the joy of shared laughter. Join the Hungama here: LXME Presents Housie Hungama. 🏠🎲 An investment of just Rs … LXME presents Housie Hungama

Uncategorized July 16, 2022

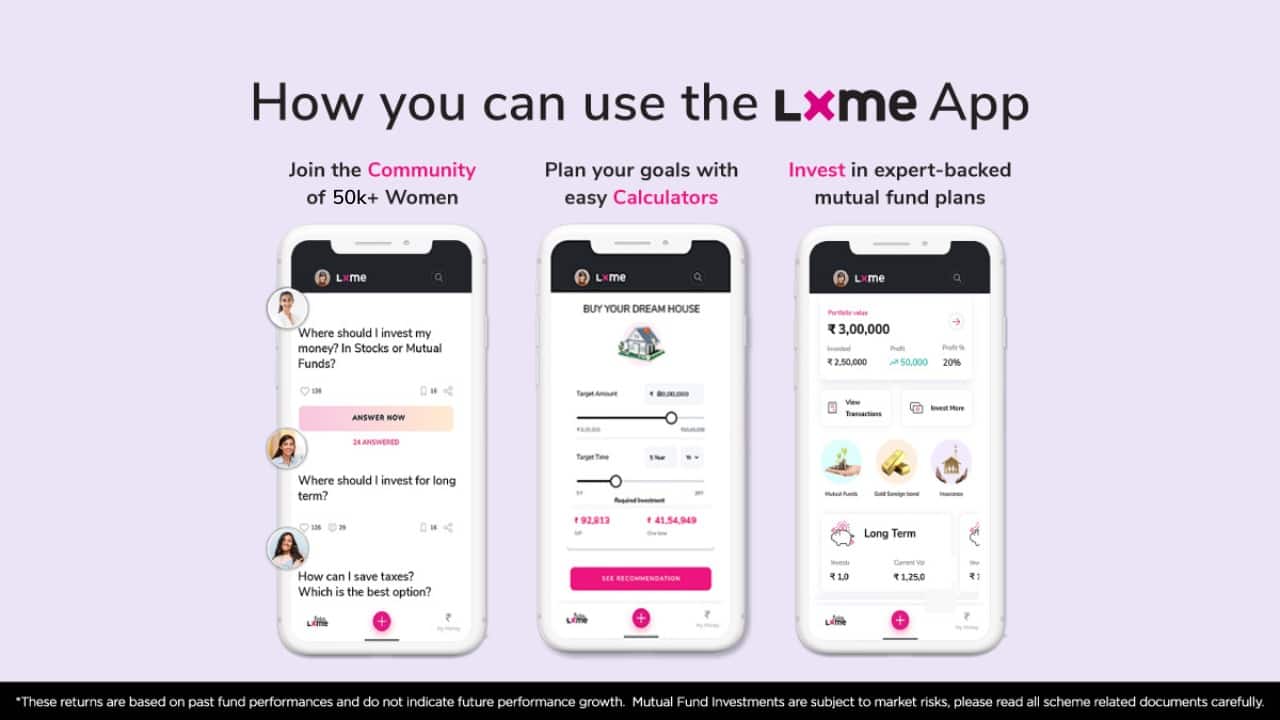

Welcome to LXME! Here is how you can use the LXME App. Read to know more

“Financial freedom is available to those who learn about it and work for it”- Rober Kiyosaki Hey! Welcome to the all-new LXME app?Let’s get to know it a little better. Watch this video So what is LXME? Did you know that only 33% of women make independent financial decisions? Perhaps women shy away from talking … Welcome to LXME! Here is how you can use the LXME App. Read to know more

Mutual Funds Uncategorized January 21, 2021

All you need to know about Index Funds

Diversification is a key element of a good investment portfolio. As investors, we try to spread our funds across various asset classes like equity, debt, real estate, gold, etc. Even within each asset class, we try to further diversify to minimize risks. In equity investing, a known method of reducing risks is diversifying your equity portfolio … All you need to know about Index Funds