While applying for any kind of loan, credit score is the most important factor checked by lenders. Besides, applying for a personal loan with low credit score is not a good option as it might cost you higher interest rates which means you’ll spend more money paying back the loan.

So, what should you do? Let’s have a look at this blog and get to know whether we can take low cibil score personal loan? Or loan on bad credit score? Factors affecting credit scores and how to improve the same.

What is a Credit Score?

A 3-digit score is used by banks/financial institutions to identify the creditworthiness of an individual. There are four major Credit Information Companies, namely CIBIL, Experian, Equifax, and Highmark in India. The most popular Credit Information Company in India is TransUnion CIBIL which gives a CIBIL Score. It ranges from 300-900. Higher the better.

What is a good credit score range?

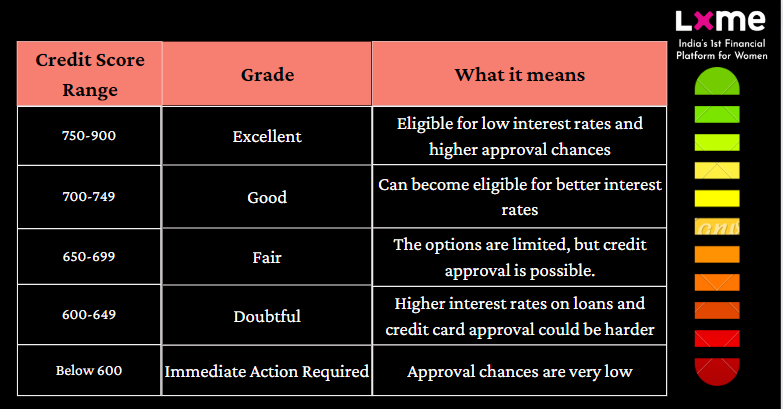

Any credit score of 750 and above is considered a good credit score. Here’s how you can assess your credit score:

What are the factors affecting your credit score?

1. Repayment History:

Previous loans are considered to check whether a person makes a timely payment or not. Payment history is the most critical factor in credit scoring, and even one missed payment can hurt your score.

2. Credit Utilization:

How much percentage of your credit limit are you using? Your credit usage is particularly represented by your credit utilization ratio. Your credit utilization ratio is calculated by dividing the total revolving credit (Revolving credit refers to an open-ended credit account like a credit card or other “line of credit” that can be used and paid down repeatedly as long as the account remains open) you are currently using by the total of all your revolving credit limits.

3. Multiple Enquiries:

Enquiring about different types of loans at the same time can indicate increased risk, and as such can hurt your credit score.

How to improve Credit Score?

1. Plan your credits:

It is important to plan your credits and apply for a loan only if it is absolutely required and when you are sure that you will be able to repay the amount you have borrowed to avoid impacting your credit score.

2. Set reminders and repay your EMIs, and credit card bills on time:

Payment history is one of the factors that is taken into consideration while calculating credit score. You can activate your payment alerts or auto debit facilities so that you do not miss any due dates this way get reminders and you can pay your bills or EMIs on time.

3. Don’t apply for too many loans at the same time:

A hard inquiry is a detailed analysis of your credit history by a lender to assess your risk as a borrower. Each time you apply for a new credit line, it triggers a hard inquiry, which can slightly lower your credit score. Multiple hard inquiries in a short time period can hurt your score.

4. Maintain a healthy credit mix:

You should maintain the right combination of secured as well as unsecured loans. A proper ratio of long-term as well as short-term debts can be maintained. Too many unsecured loans may hurt your credit score.

5. Consider Tenor of Loans:

When borrowing a loan make sure that you consider your affordability. If you have financial limitations, you could go for a longer loan term. That way, you’ll have lower EMI’s and won’t stress your finances.

6. Review Your Credit Reports:

To improve your credit score you can review your credit reports periodically this will help you to see what’s helping or hurting your score.

7. Use your credit limit:

Utilize your credit limit smartly. It is good to keep a gap between how much credit you use and your total credit limit. For example, if your limit is 1 lakh, try to use only 30%. This ensures you pay it back comfortably and keeps your credit score healthy. Using up the entire limit can be risky and might hurt your score if you can’t pay it back.

Once you maintain a good credit score then you can apply for any type of loan. It is always better to take a loan when you have a good credit score. However, it might be difficult to get a personal loan if you have a low credit score, as lenders look at your credit score to determine how likely you are to repay a loan.

You can safely avail a personal loan with LXME for all your emergency expenses with just 3 steps. Check your eligibility, select loan amount & tenure, upload KYC, verify your bank account, and money will be disbursed to your account!

On the ending note, “Credit report and credit score are two of the most vital aspects of your financial health” -Erin Lowry

You can bookmark this one-pager for your future reference.���

Comment “Need Assistance” if you want to start investing.

And let us know in the comment section, on which topic you would like us to write a blog for you.

FAQs

Can I apply for a home loan with a low CIBIL score?

The minimum CIBIL Score required for a home loan is 650 which is considered by lenders which means you won’t get a home loan for low credit score. However, If your CIBIL score is below 650 then you might be eligible for a home loan application. So, before applying for a home loan make sure the CIBIL score is 650 and above.

How to check my credit score for free?

This question might have popped up in your mind. So, the answer to this question is you can check online for free at https://www.cibil.com/

Share this blog with your family and friends if you find it insightful!!

Download the LXME app for more such content!

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Loan July 20, 2024

Choosing the Best Platform for Personal Loans: A Comprehensive Guide to LXME

We have a number of needs in our everyday lives for which we may require financial help. For women, this can mean anything like setting up a business, renovating a house, etc. So, learning about loans is also as important in order to make an informed decision. So, let’s learn about loans, best loan app … Choosing the Best Platform for Personal Loans: A Comprehensive Guide to LXME

Loan July 4, 2024

Boost Your Chances of Instant Loan Approval online?

In the fast-paced digital era, securing financial assistance has never been more convenient, thanks to instant loan approval online. Discover the seamless process of obtaining swift financial solutions right from the comfort of your home. Our comprehensive guide sheds light on the key aspects and tips for loan approval online, ensuring you navigate the process … Boost Your Chances of Instant Loan Approval online?

Loan

Effective Strategies: How to Manage Loans Wisely

Are you wondering how to manage debt effectively and take control of your financial journey? You’re in the right place! In this comprehensive guide, we’ll walk you through 7 essential tips on debt management skills with confidence and achieve your financial goals. Whether you’re dealing with student loans, mortgages, or personal loans, these practical strategies will help … Effective Strategies: How to Manage Loans Wisely