- Products

-

Financial Calculators

- All Calculators

- Compound Interest

- Simple Interest

- Home Loan EMI

- Personal Loan EMI

- Car Loan EMI

- Emergency Fund

- Inflation Calculator

- SIP Calculator

- Lumpsum Calculator

- Salary Calculator

- Travel Calculator

- Retirement Planning Calculator

- PPF Calculator

- Child Education Calculator

- Goal Calculator

- Sukanya Samriddhi Yojana Calculator

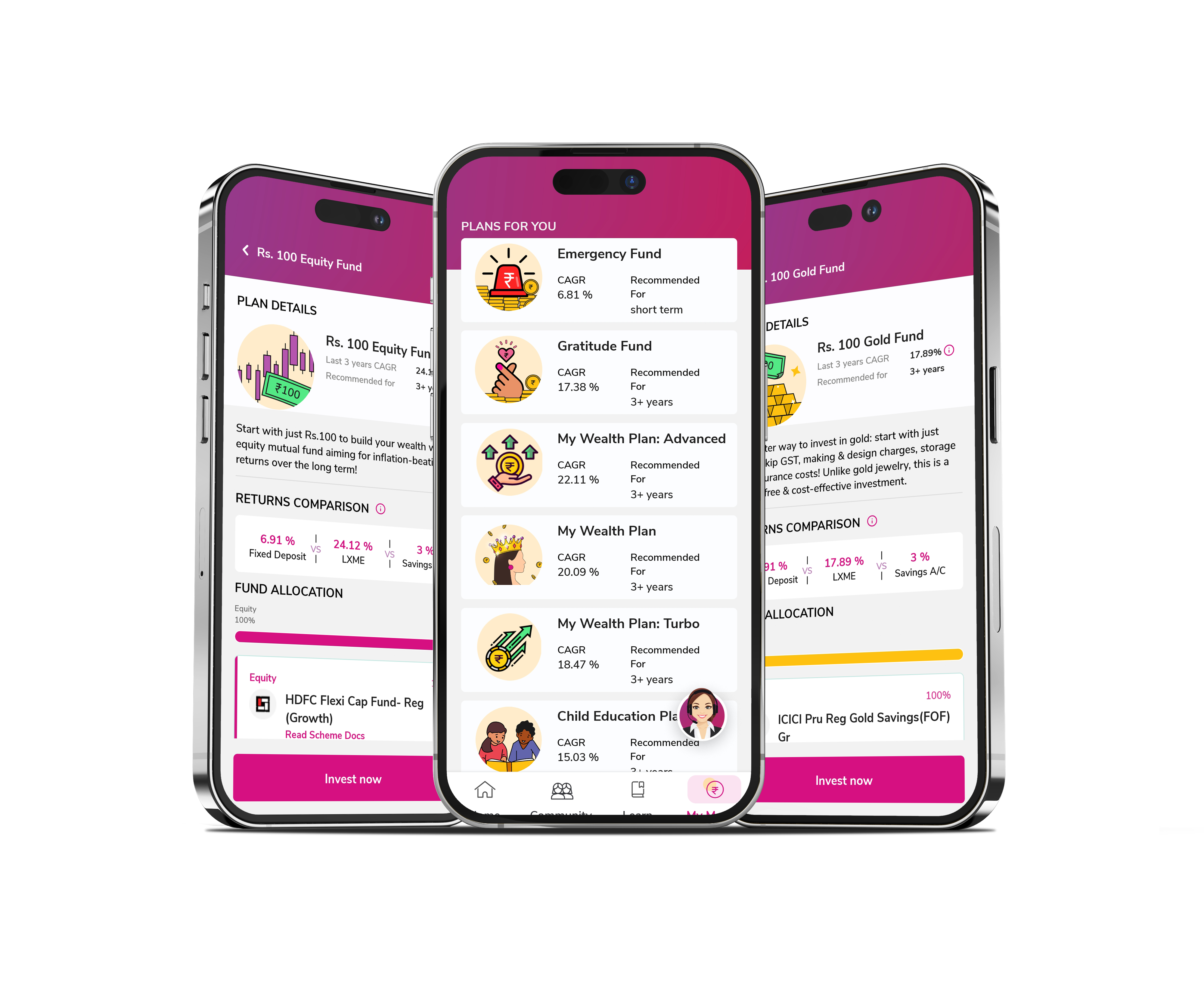

- Plan

- Resources

- Latest

- About Us