In the dynamic landscape of parenting, empowering our children with essential life skills takes center stage. One crucial aspect often overlooked is teaching kids about money. As we delve into the insightful blog, we embark on a journey to discover practical and engaging ways to instill financial wisdom in our young ones.

Let’s unravel the key lessons that LXME unfolds, guiding parents toward nurturing financially savvy and responsible individuals.

Mom – Sitting at the kitchen table, counting her monthly bills.

Pranjali – Curiously watches Mom and decides to strike up a conversation, “Mom, what are you doing?”

Mom – “Hi, sweetheart! I’m sorting out the bills for our house. It’s something adults do to manage their expenses.”

Pranjali – Puzzled “But where does the money come from?”

Mom – Inviting her to sit beside her “That’s a great question, my dear. Money comes from working hard and earning it. Just like how you earn your pocket money by helping me with the chores.”

Pranjali – Eyes widening “So, money doesn’t just magically appear?”

Mom – Chuckles “No, it doesn’t. It’s important to understand that money is earned and should be managed wisely. Let me tell you the 5 things that will make you money smart.”

Pranjali – Curiosity piqued “Really? Tell me more, Mom!”

And so begins their journey to discover the 5 things that can help Pranjali develop the skills and mindset needed to make wise financial decisions by developing a strong financial foundation.

By introducing good money habits and providing them with essential knowledge, parents can empower their children to become money smart from an early age.

1. Teach them Basic Money Concepts –

Introducing basic money concepts is an excellent way to lay the foundation for financial literacy. Teach your child about different denominations of currency, how to count money, how to save it, e.t.c.

Encourage them to save their pocket money or earnings from small chores in a piggy bank or savings account, parents can teach their child the value of delayed gratification (choosing to postpone immediate satisfaction in order to attain greater rewards or benefits in the future) and develop a sense of financial responsibility.

2. Teach them the difference between needs and wants –

In a consumer-driven society, it’s essential to teach children the difference between needs and wants. Help them understand that needs are essential for survival such as food, shelter and clothing, while wants are things that provide pleasure but aren’t really necessary.

By understanding this distinction, children learn to make informed decisions about their spending.

3. Budgeting and Goal Setting –

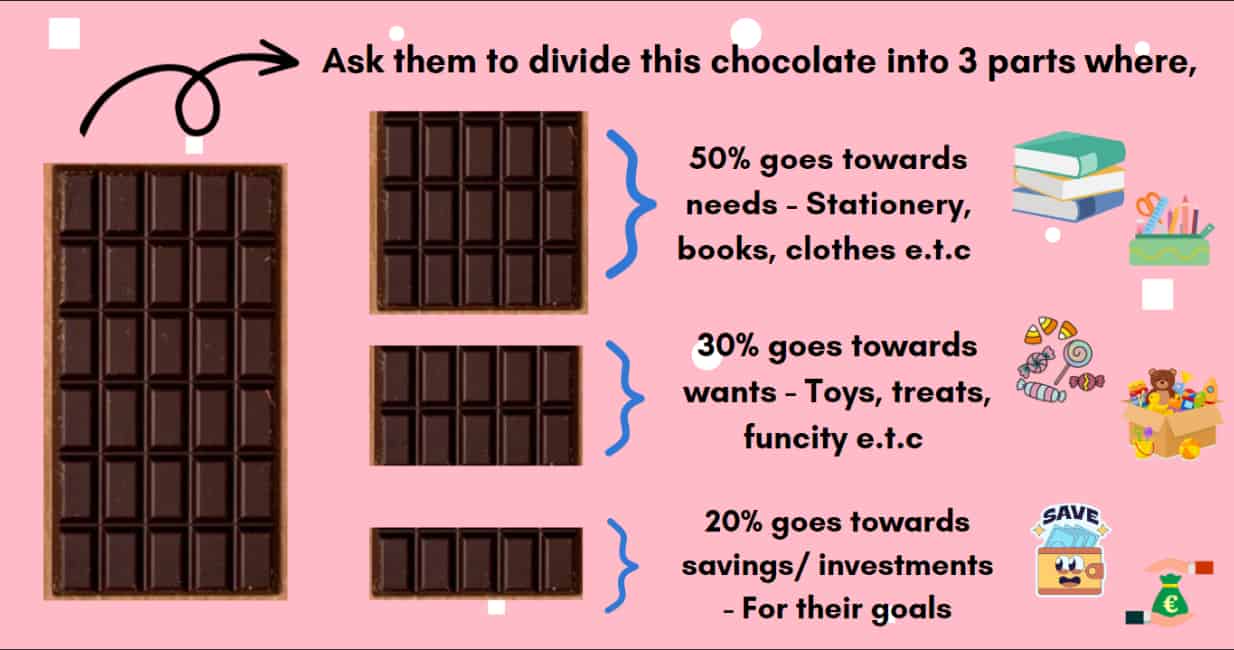

Teach your child about the importance of budgeting and goal setting. Explain how money needs to be allocated for different purposes such as saving, spending, and investing. Help them create a simple budget by setting spending limits for various categories, such as toys, treats, stationery and discretionary expenses.

You can explain the 50-30-20 budget rule simply by giving them chocolates and dividing them as per the rule –

By learning to prioritize their spending and save for things they want, children develop crucial money management skills.

4. Cultivate a mindset of Financial Responsibility-

In addition to the above points, it’s crucial to cultivate a mindset of financial responsibility in your child. Help them understand the significance of making wise financial decisions.

Encourage them to think critically about their purchases and consider factors like quality, utility and long-term value. By instilling the mindset of financial responsibility, you empower your child to make sound choices that align with their goals and values.

5. Introduce the concept of Investing –

Teach the concept of investing to your child in an age-appropriate manner. Explain that investing involves putting money into something that has the potential to grow or generate returns in the future. Encourage them to set aside a small portion of their savings for long-term investments.

Teaching children about the power of compounding and the potential benefits of investing can set them on a path toward financial security and future wealth accumulation.

“What a child can do today with assistance, she will be able to do by herself tomorrow.”

–Lev Vygotsky

Bottom line –

By implementing these 5 strategies, Moms can empower their children to become Money-smart individuals who can make informed financial decisions throughout their lives. Remember, teaching children about money is an ongoing process, so it’s essential to have regular conversations about finances and provide opportunities for hands-on learning.

By equipping your child with these valuable skills, you are setting them up for a lifetime of financial success.

Unleash your child’s potential with invaluable life skills that go beyond the classroom!

Prepare them for a successful financial future with the “LXME Summer Money Camp for Kids”, a thrilling path where they’ll discover the true value of money through captivating stories, priceless wisdom, and exciting interactive games.

Don’t let this summer slip away! Create an unforgettable, enriching experience for your Child!

While you’re doing this, secure your child’s future to provide them with the best opportunities.

You can use LXME’S Child Education Calculator for planning your child’s education. It will help you to calculate how much corpus will be required for his higher education and the amount you need to invest to reach that corpus. It gives you options for SIP/lumpsum investment to achieve your goal of securing the financial future of your son.

Check out LXME’s Child Education Plan which is a mix of 70% equity and 30% debt funds best suited for your long-term goals, targeting 14% p.a returns* and the portfolio is well-researched, diversified, and curated by experts.

FAQs around Teaching kids about money

Q: How do I teach my child about money?

Start Early: Introduce basic concepts like saving and spending from a young age. LXME’s blog on teaching kids about money offers practical tips.

Make it Fun: Turn money lessons into games. Use play money to teach counting and budgeting, making the learning process enjoyable for kids.

Set an Example: Children learn by observing. Demonstrate responsible financial habits, and discuss your decision-making process regarding money matters.

Hands-On Experience: Give kids a small allowance to manage. This provides real-life practice in budgeting and making choices.

Use Technology: Explore kid-friendly finance apps that make learning about money interactive and engaging.

Q: What is money for kids?

Tool for Exchange: Money is a tool that helps buy things. LXME’s blog details how to explain this concept to kids, emphasizing the idea of exchanging money for goods and services.

Save, Spend, Share: Teach kids that money can be saved for future goals, spent wisely, and shared with others in need.

Value Understanding: LXME’s insights highlight instilling values associated with money, such as responsibility, generosity, and smart decision-making.

Learning Resource: Money becomes a learning resource, empowering kids with skills essential for their future financial well-being.

Incorporate these strategies and insights from LXME to make teaching kids about money a positive and enriching experience.

Share this blog with your friends and family if you find it insightful!!

Download the LXME app now to start investing! Happy Investing!

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Lifestyle Parenting May 20, 2024

12 Pregnancy Tips for First Time Moms

Mommies-to-be, excited to enter this new and exciting phase of your life!? A mini-you will soon roam around this world and you’ll absolutely love them– no conditions attached. We understand that pregnancy tips for brand-new moms can sometimes sound like advice in an alien language. That’s why we are sharing down-to-earth, money-minded first time pregnancy … 12 Pregnancy Tips for First Time Moms

Career Parenting April 11, 2024

13 Ways to Make Money as a Stay-At-Home Mom

Hello Wonder Woman! We know being a stay-at-home mom is one of the toughest jobs out there. From managing the household to keeping the kids in line, you’re a real-life superhero! But let’s be honest, with all that multi-tasking, finding time to earn a little ‘mom money’ on the side can feel impossible. Well, don’t … 13 Ways to Make Money as a Stay-At-Home Mom

Parenting March 14, 2024

5 Key Questions to Ask Yourself Before Having a Baby

Are you considering starting a family? Before taking this profound step, it’s crucial to delve into essential queries. Our blog, “5 Weighty Questions to Ask Yourself Before Starting a Family,” on LXME, serves as your guide. These questions for parents to be strategically curated, explore aspects such as financial readiness, emotional preparedness, and the impact … 5 Key Questions to Ask Yourself Before Having a Baby