The season’s changing but it’s still raining money here at LXME. We have an exciting lineup of money challenges coming your way in September. Read to find out more about this:

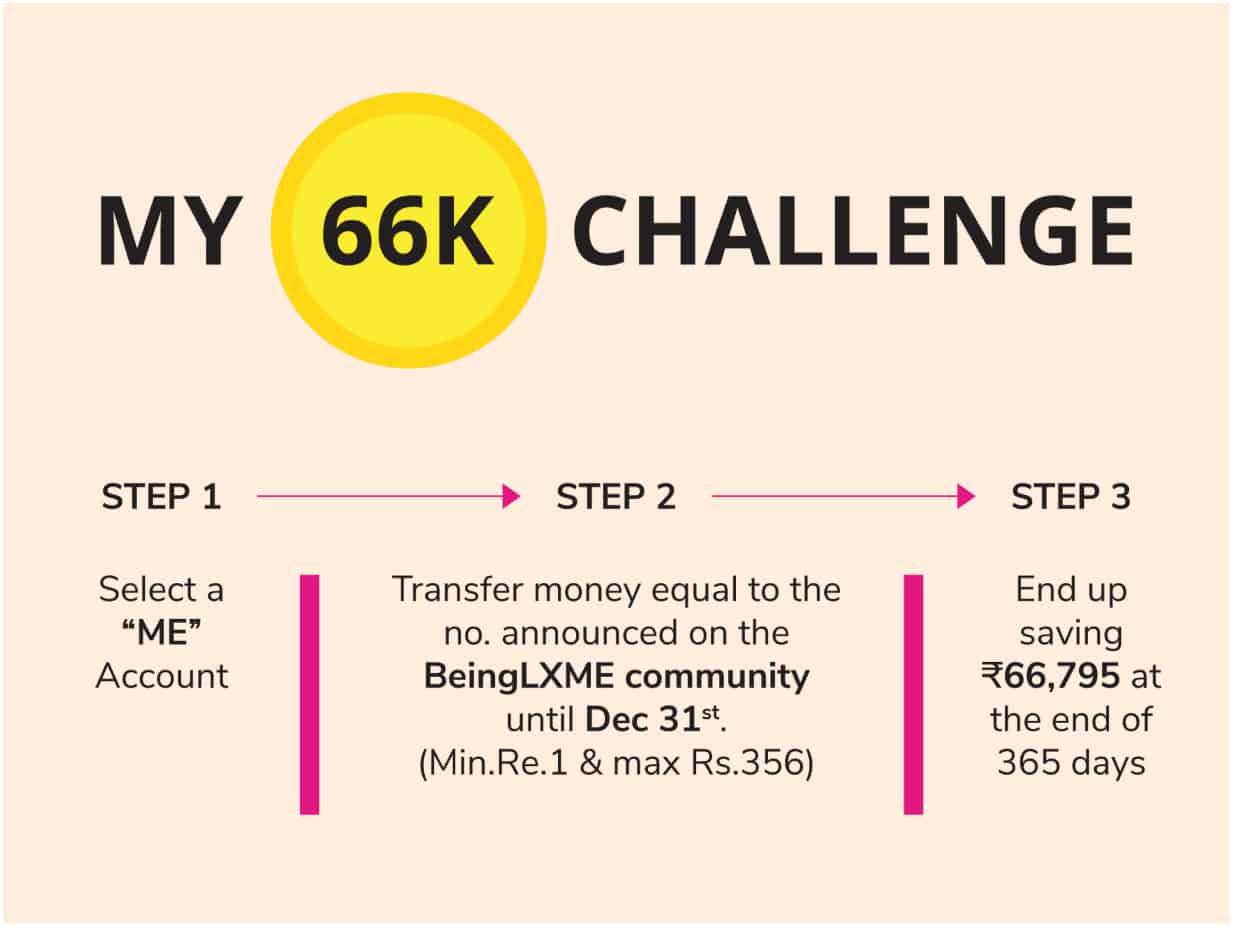

My 66K Challenge

What if we told you that by *Dec 31, 2021, you will have Rs.66795 in your “ME bank a/c” (normal saving bank a/c used only for YOUR savings & investments) just by saving as little as Re.1 & max Rs.365 per day? Yes, it’s possible!

What you need to do

The challenge calls for you to save any amount between Re.1 to Rs.365. Each day team LXME will post a number. Any number is chosen from 1-365. That is the amount you need to transfer into your ‘ME account’.

What is a me account?

A bank account that is used only for your savings & investments. You do not make any expenses out of it. A lot of you may have this account. In case not, good idea to make one. This is a simple savings account. We call it the ME account because it is YOUR account for YOUR personal wealth! *Please note that this is a daily challenge that was started in January 2021. In case you’ve missed out on the daily numbers till now, all you have to do is ask our community members and they’ll help you!

The LXME September Hack

We buy things at discounted rates online, when we go grocery shopping we get discounts there as well, but are we really saving the money? What do we do with the money we save? We spend it on other things!

So here’s the September Hack! This month, whatever money you save when you buy something at a discounted rate should be transferred to your ME account, even if it is as little as Rs.20.

For example, if you buy a t-shirt worth Rs.700 at a discount is 10%, you will pay Rs.630 for the t-shirt and transfer Rs.70 to your ME account.

Follow this for every purchase you make this September and at the end of the month see how much money you will end up saving.

Daily Market Updates

Watch out for daily updates on the ups and downs of the stock markets and be more financially aware!

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Lifestyle Money Hacks July 3, 2024

Positive Money Mindset Tips for Women

How do you feel when someone mentions finances? Stressed, hopefully, or just numb? Women and money can have a stressful, complicated relationship. You need to feel good about money if you want to be financially free. Women feel better about themselves and have more control over their money when they have a good relationship with … Positive Money Mindset Tips for Women

Credit Card Money Hacks June 29, 2024

Credit cards can be magic cards when used correctly!

Your credit card offers 15% off apparel and accessories. The first time you meet it, it promises to be your friend—until you look closely and realize it’s not. You have been ripped off. The unstoppable scoffing running into your mind, “Should have read the fine prints. Should’ve known before getting into this”. The hit on … Credit cards can be magic cards when used correctly!

Lifestyle Money Hacks

5 Mind-Blowing Money Saving Hacks!

Hey savvy savers! Ready to up your money game? LXME has your back with the ultimate guide to money saving tips and tricks. No boring budget talks—just real, actionable tips to make your money work harder. Let’s kickstart your journey to financial freedom, one money saving method at a time! Right at the onset, let … 5 Mind-Blowing Money Saving Hacks!