In the second part of our five-part series on investments, we’ll discuss the best time to invest and whether there really is a ‘right’ or ‘wrong’ time for it. In the last post, we touched upon the concept of compounding, which is almost like magic. Gains get reinvested, earning more gains and so on, kicking off a cycle of earning. At some point, you can just sit back and let your investments do all the work for you! There’s a catch, though. It takes years for compounded gains to add up to any substantial amount. This is where starting early makes a difference, since the same sum will earn you more if it’s invested earlier.

LET’S LOOK AT A BASIC EXAMPLE OF THIS CONCEPT:

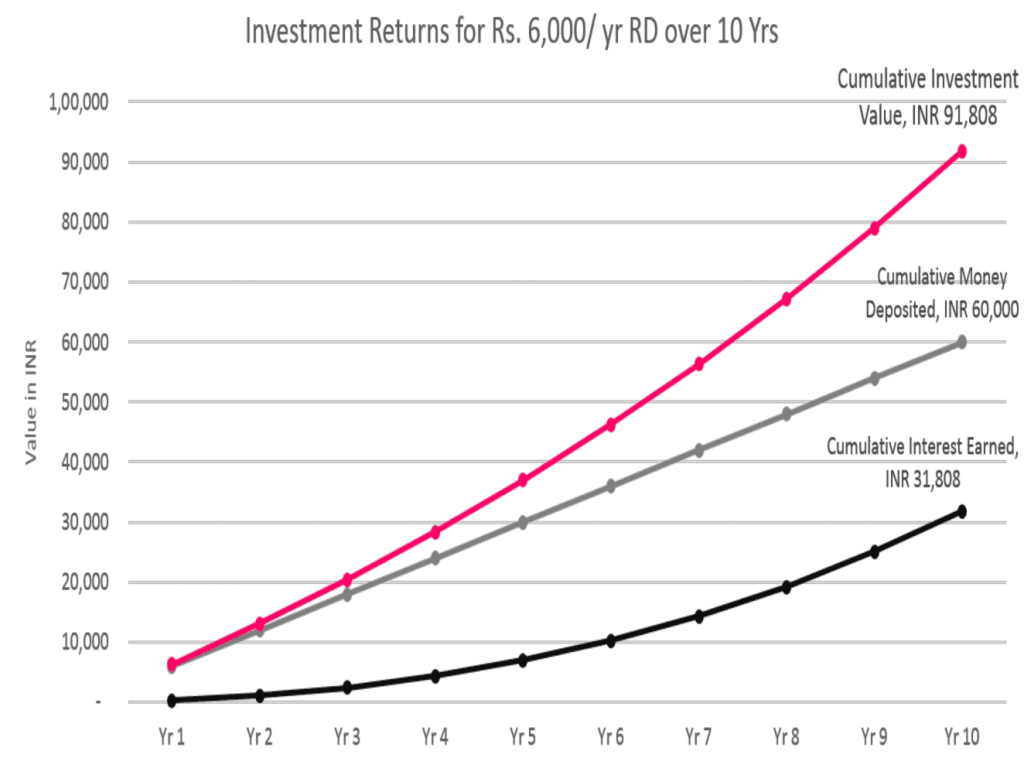

Nishi opens a 10-year recurring deposit account that offers 8% interest per annum, compounded quarterly. By putting in as little as Rs. 500 every month, Nishi earns almost Rs. 32,000 in interest and receives just under Rs. 92,000 upon maturity:

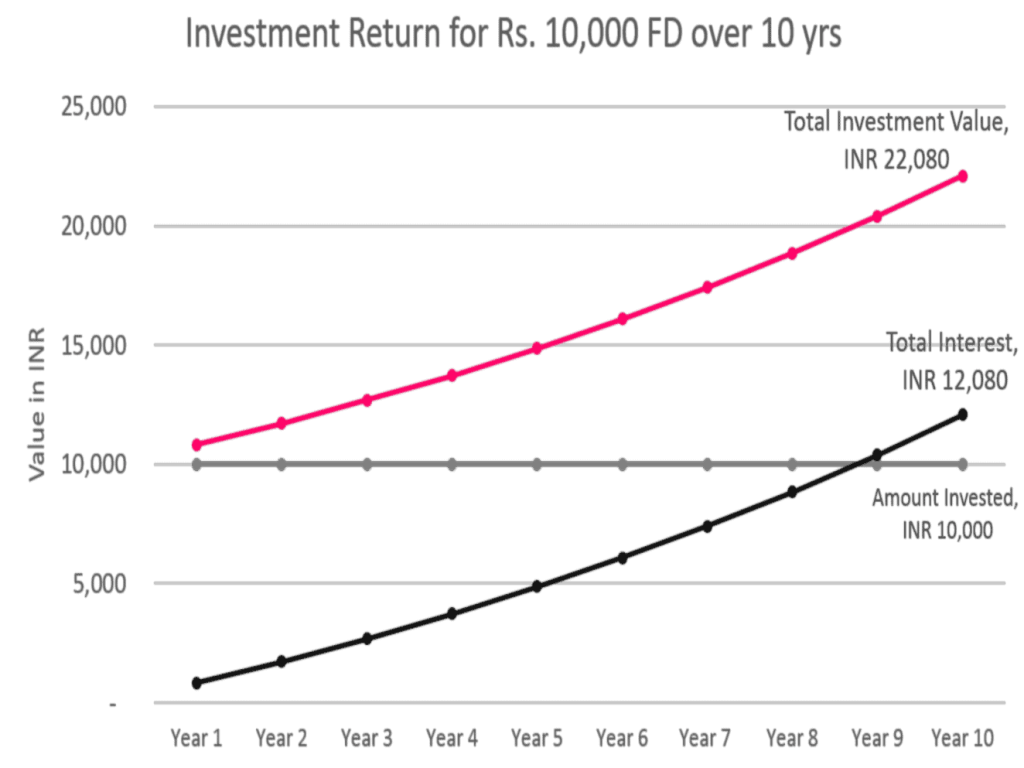

Here’s another example to consider: Shalini receives a cheque for Rs. 10,000 as a gift on her 20th birthday. Instead of spending this money or stashing it in her savings account, she invests in a 10-year fixed deposit that offers 8% interest per annum, compounded quarterly. By her 30th birthday, this FD will have more than doubled in value, earning over Rs. 12,000 in interest:

If the same amount had been invested five years later, Shalini would have earned less than Rs. 5,000 in interest by the time she turns 30. The only difference in these two scenarios is the amount of time her money has had to grow. This is just the tip of the iceberg.

Imagine what happens over two or three decades, with investments that offer even higher rates of return. So, the answer to the question ‘when should you invest?’ is NOW. Don’t wait any longer. Yesterday would have been better, but it’s never too late (or too early) to start investing. Put your money to work right away!

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Lifestyle Money Hacks July 3, 2024

Positive Money Mindset Tips for Women

How do you feel when someone mentions finances? Stressed, hopefully, or just numb? Women and money can have a stressful, complicated relationship. You need to feel good about money if you want to be financially free. Women feel better about themselves and have more control over their money when they have a good relationship with … Positive Money Mindset Tips for Women

Credit Card Money Hacks June 29, 2024

Credit cards can be magic cards when used correctly!

Your credit card offers 15% off apparel and accessories. The first time you meet it, it promises to be your friend—until you look closely and realize it’s not. You have been ripped off. The unstoppable scoffing running into your mind, “Should have read the fine prints. Should’ve known before getting into this”. The hit on … Credit cards can be magic cards when used correctly!

Lifestyle Money Hacks

5 Mind-Blowing Money Saving Hacks!

Hey savvy savers! Ready to up your money game? LXME has your back with the ultimate guide to money saving tips and tricks. No boring budget talks—just real, actionable tips to make your money work harder. Let’s kickstart your journey to financial freedom, one money saving method at a time! Right at the onset, let … 5 Mind-Blowing Money Saving Hacks!