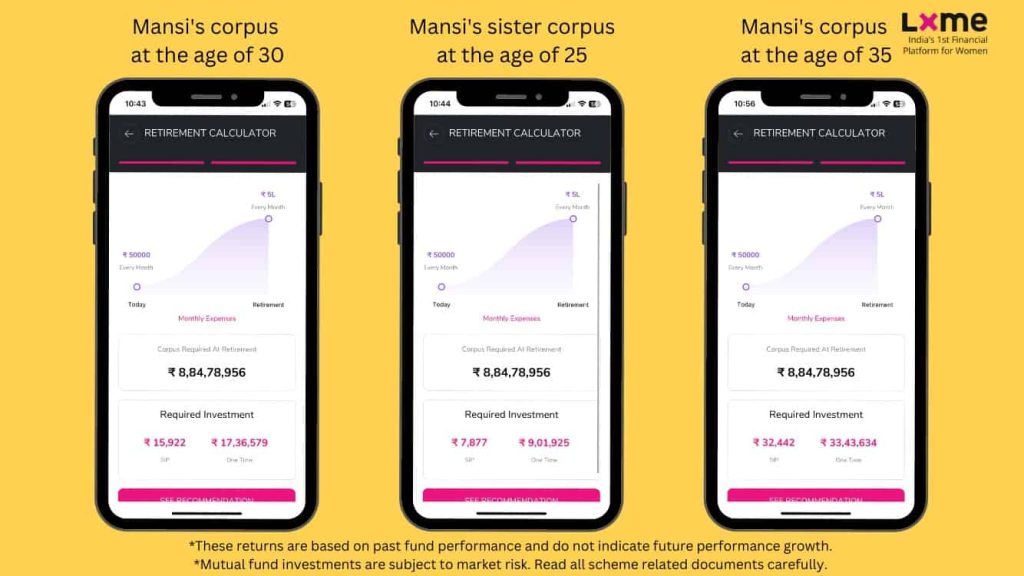

Mansi, a 30 year old graphic designer, hasn’t started her retirement planning yet. After using LXME’s eye opening Retirement Calculator, she realized she needs a whooping 8.84 crores when she retires! She immediately starts a SIP of Rs, 15,922. She recommends the calculator to her 25 year old sister who needs the same amount at the time of retirement, but started with a SIP of 7,877. Why the difference between Mansi and her sister? That’s because of compounding. Hence, the importance of retirement planning, when you start early, you can set aside small amounts because you will have more time for your money to grow.

What is retirement planning?

Retirement planning involves strategically managing finances and investments to ensure a secure and comfortable lifestyle post-employment. It includes assessing future needs, saving, and investing wisely during one’s working years to build a sufficient nest egg, providing financial stability and peace of mind during retirement.

Below is a step by step guide for start Retirement Planning

1. Know when to start:

The best time to start retirement planning is in your 20’s. The earlier you start, the more time you have for the ‘ Magic of Compounding’ to happen. Well, although it is never too late to start investing your money for retirement planning, it is always better to start early. If Mansi would have waited for 5 more years, her SIP would have been Rs. 322,442.

2. Use the LXME Retirement Calculator:

Check out LXME’s Retirement Calculate to find out how much you need at the time of retirement. Simply, add your current age, retirement age, life expectancy and monthly expenses. LXME’s Calculator will tell you the required corpus you need when you retire. What are you waiting for, start to plan for retirement and go check it out NOW!

3. Prioritize your other financial goals:

Other than retirement planning, there are various other financial goals to start investing for. Goals vary from person to person like buying a house or a car or planning to travel across Europe. Saving for your Emergency Fund is also a very important goal to plan for retirement. Ideally, you should plan and save for your other goals, at the same time you are planning for retirement.

4. Start Investing with LXME:

Once you have figured out your financial goals, it is time to start investing. Check out LXME’s Long Term Portfolio and start investing to reach your desired corpus at the time of retirement

5. Monitor your portfolio:

The final step to plan for your retirement is to constantly monitor your portfolio time and again and make the required adjustments. There are various life stages where your priorities and goals can change. There can be some unexpected expenses too that can come along the way.

So ladies, what are you waiting for? Start your retirement planning NOW!

*These returns are based on past fund performance and do not indicate future performance growth.

*Mutual fund investments are subject to market risk. Read all scheme related documents carefully.

FAQs: Plan for Retirement

What is retirement planning?

Retirement planning is managing finances during one’s working years to secure a comfortable lifestyle post-employment. It involves saving, investing, and assessing future needs to build a financial cushion for retirement.

How should I plan for retirement?

Plan for retirement by setting clear financial goals, saving consistently, investing wisely in diverse assets, and regularly reassessing your plan. Consider healthcare, inflation, and lifestyle expectations to ensure a financially secure and fulfilling retirement.

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Retirement June 27, 2024

Retirement planning: how to plan for a retirement

Welcome to a comprehensive guide about Crafting Your Path to a Successful Retirement. where we delve into how to plan for retirement and unveil the secrets to a prosperous and fulfilling retirement. In this guide, we’ll explore the thrilling world of retirement investing and how you can embark on this journey with LXME. So, let’s … Retirement planning: how to plan for a retirement

Mutual Funds Retirement February 22, 2024

Early Retirement Planning Guide: Secure Your Future Today

Welcome to our comprehensive guide on early retirement planning! At LXME, we understand the significance of crafting a secure financial future that allows you to retire on your terms. In this blog, we delve into the intricacies of early retirement planning, offering valuable insights, expert advice, and practical strategies. Join us on a journey toward … Early Retirement Planning Guide: Secure Your Future Today

Lifestyle Retirement January 22, 2024

How to Retire at 50? – A Comprehensive Plan

Retirement Planning is one of the crucial aspects of financial planning that everyone needs to consider. It will help you take care of your post-retirement days and to lead a stress-free life. As per the Women and Money Power 2022 survey, only 2 out of 100 women save for their retirement. That’s why especially for women, … How to Retire at 50? – A Comprehensive Plan