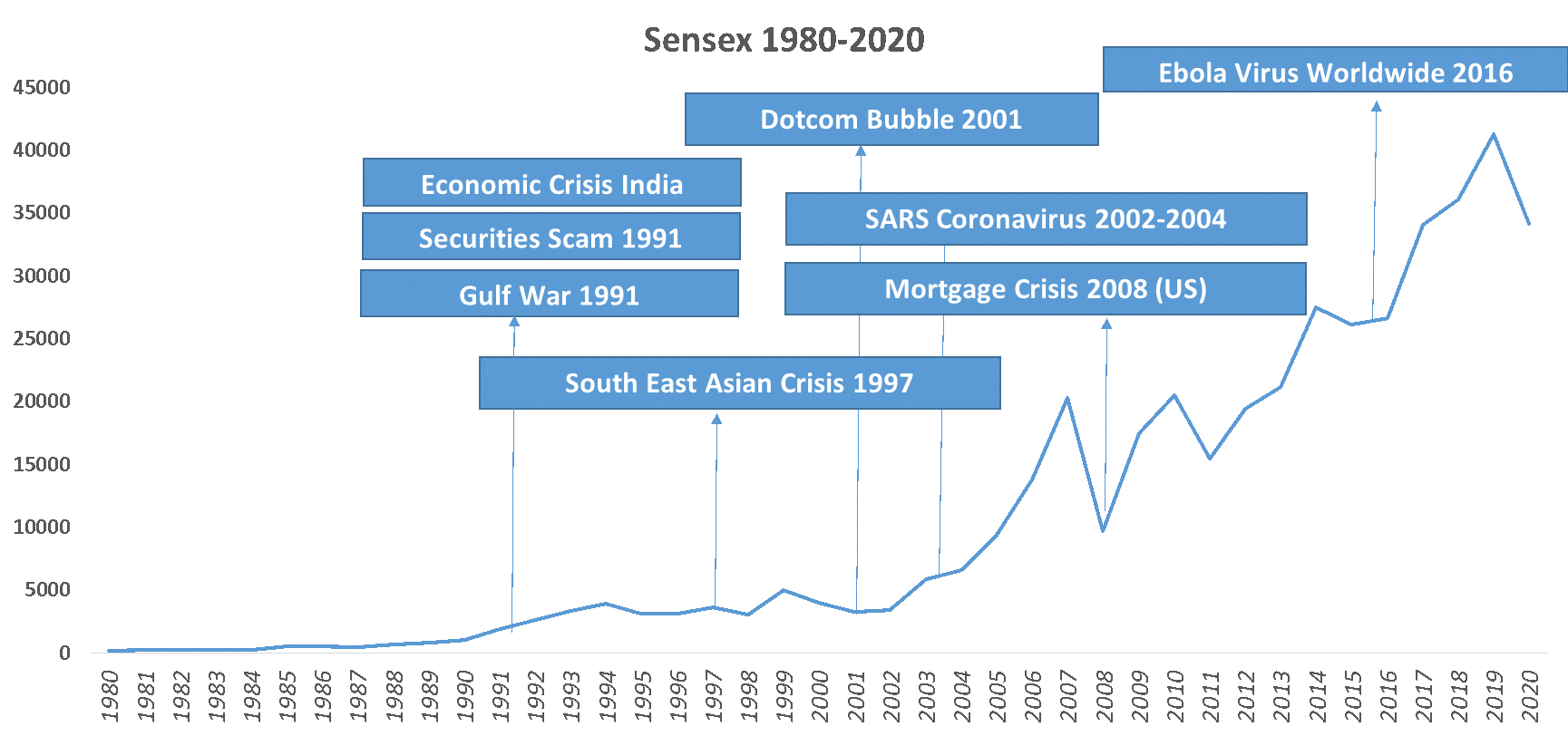

(Graph is indicative, Source: BSE Data)

The fear of coronavirus outbreak and its impact on the global economy, has had a crushing impact on the global stock markets. In what could be termed as the worst week for stocks after the 2008 financial crisis, investors instantly became sellers as the fear of a global pandemic spread. But market crashes are not new. And it is also important to understand, that any major financial global crisis; be it financial or a pandemic, markets bounce back- something we can easily spot historically. Between 1980 and 2020, there have been over two-dozen events where economies including the US, Japan, Europe and other emerging economies have faced a major crisis, with the most recent one being the Sub-prime crisis of 2008. These events led to a sudden crash in the global stock markets. A pandemic like Coronavirus is new for the stock markets with no such instances of comparable scale from the recent past. Thus a sudden market crash is quite obvious given the uncertainty surrounding its impact on an economy. But should we be worried as long term investors?? Is there a reason to panic from here?? If we take a look at the performance of Sensex (benchmark index of BSE), and study its performance over the last 40 years (1980-2020), it gives us a sneak-peak into what an investor could expect from this crisis and its impact on their investment portfolios.

- Sensex crashed by over 50% from its peak in 2008, but recovered quickly over the next 12 months.

- In comparison, the coronavirus pandemic has led to ~27% drop in Sensex from its 2019 peak. This would mean, some of your recent investments would have given negative returns, but they would recover gradually along with the markets.

It would be too early to say that the stock market crash may be over, but Government’s world over as well as the Indian Government have been making policy announcements at break-neck speed- enough to calm the stock markets. These policy announcements include stimulus packages for ailing industries and the population at large.

- Central banks world over have cut policy rates- RBI too has brought down its policy rates to multi-decade low of 4.4%. This in turn would lead to lowering of borrowing costs, which would support economic growth, once the pandemic and its impact subsides.

To conclude, for a long term investor, even at the current level of Sensex, ₹ 1000 invested in 1980 would have grown to ₹ 2,02,000 (~202 times) in 2020. We recommend: Stay invested, Stay Safe! Do not panic. Your investments are only bound to grow.

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Career July 25, 2024

How to Start and Grow Your Own Business

It’s both exciting and hard to grow and start a business. You need to have a plan and a strategy, and you need to stick to it to start your own business. There are some steps you must take before you can start your own tech, retail, or consulting business, so let’s see how to … How to Start and Grow Your Own Business

Career Lifestyle July 1, 2024

Steps to Prevent or Handle Workplace Harassment

Harassment at workplace comes as a very big issue. It can be defined as threatening behaviour by anyone at the workplace which can include insults, explicit messages, threats, bogus rumors, and offensive displays among other things. It can affect mental & physical health along with work performance. Cases of workplace harassment seem to be only … Steps to Prevent or Handle Workplace Harassment

Career June 24, 2024

Active Income vs Passive Income: Know the Difference

Life is about living and not just barely surviving from paycheck to paycheck. We all want financial freedom, right? To live life on our own terms, without worrying about making ends meet. We do too. Let’s talk about different types of income and the difference between active income and passive income. Believe it or not, … Active Income vs Passive Income: Know the Difference