Here’s a small step towards big rewards. Enjoy this firecracker of an offer, ladies!

Open your LXME Account and save up to Rs.10,000 on your favourite brands!

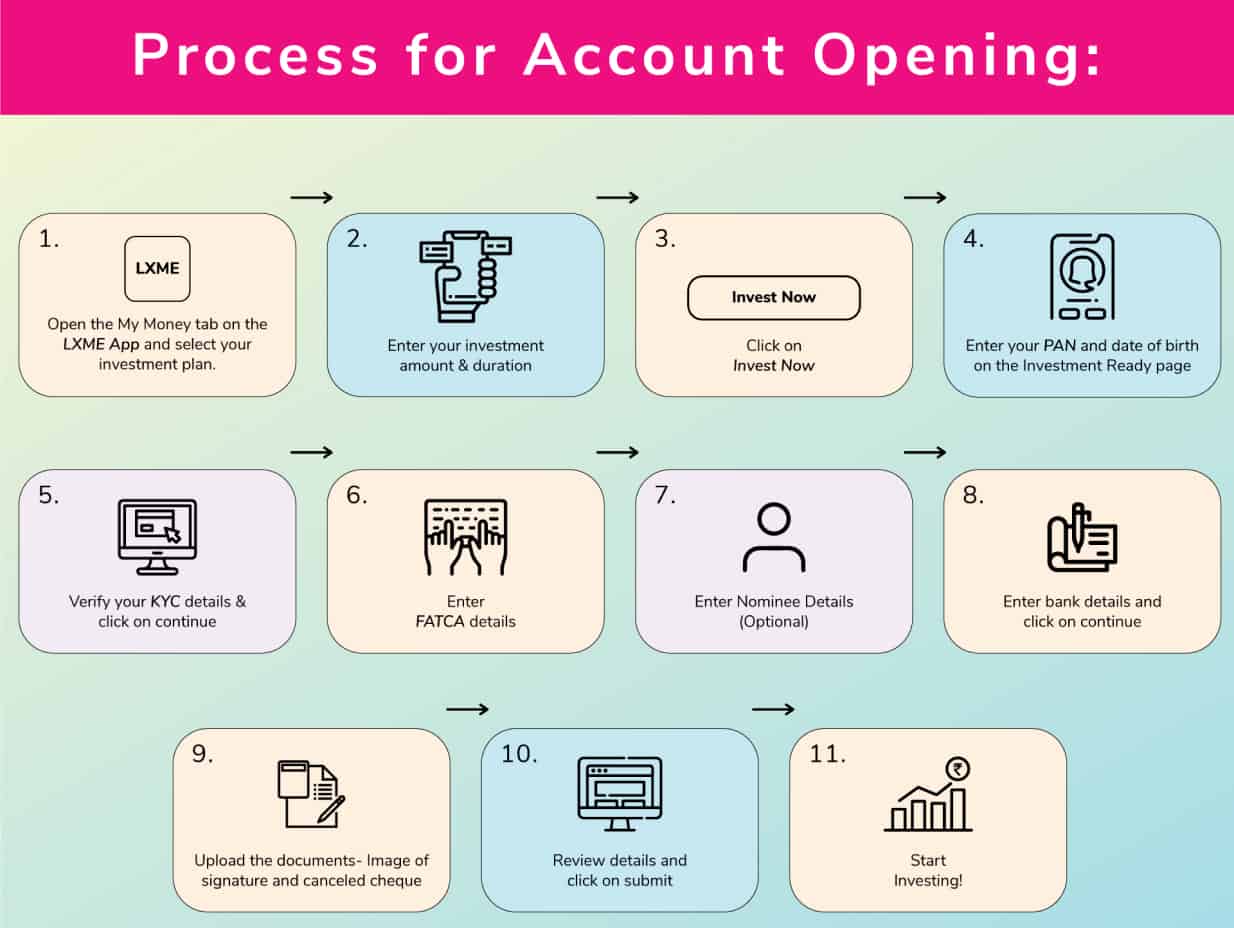

Now you must be wondering opening an account would be a tedious task, well it’s not!

LXME has simplified the account opening process for you, it’ll only take 5 mins to open your account and be investment AND shopping ready!

- Open the My Money tab on the LXME App and select your investment plan

- Enter your investment amount & duration.

- Click on invest now.

- Enter your PAN and date of birth on the Investment Ready page

- Verify your KYC details & click on continue

- Enter FATCA details

- Enter Nominee details (optional)

- Enter bank details and click on continue

- Upload the documents- Image of signature and cancelled cheque/ bank statement (with name and account number visible)

- Review details and click on submit

- Start SHOPPING & INVESTING!

Open your Account with LXME NOW! Click here.

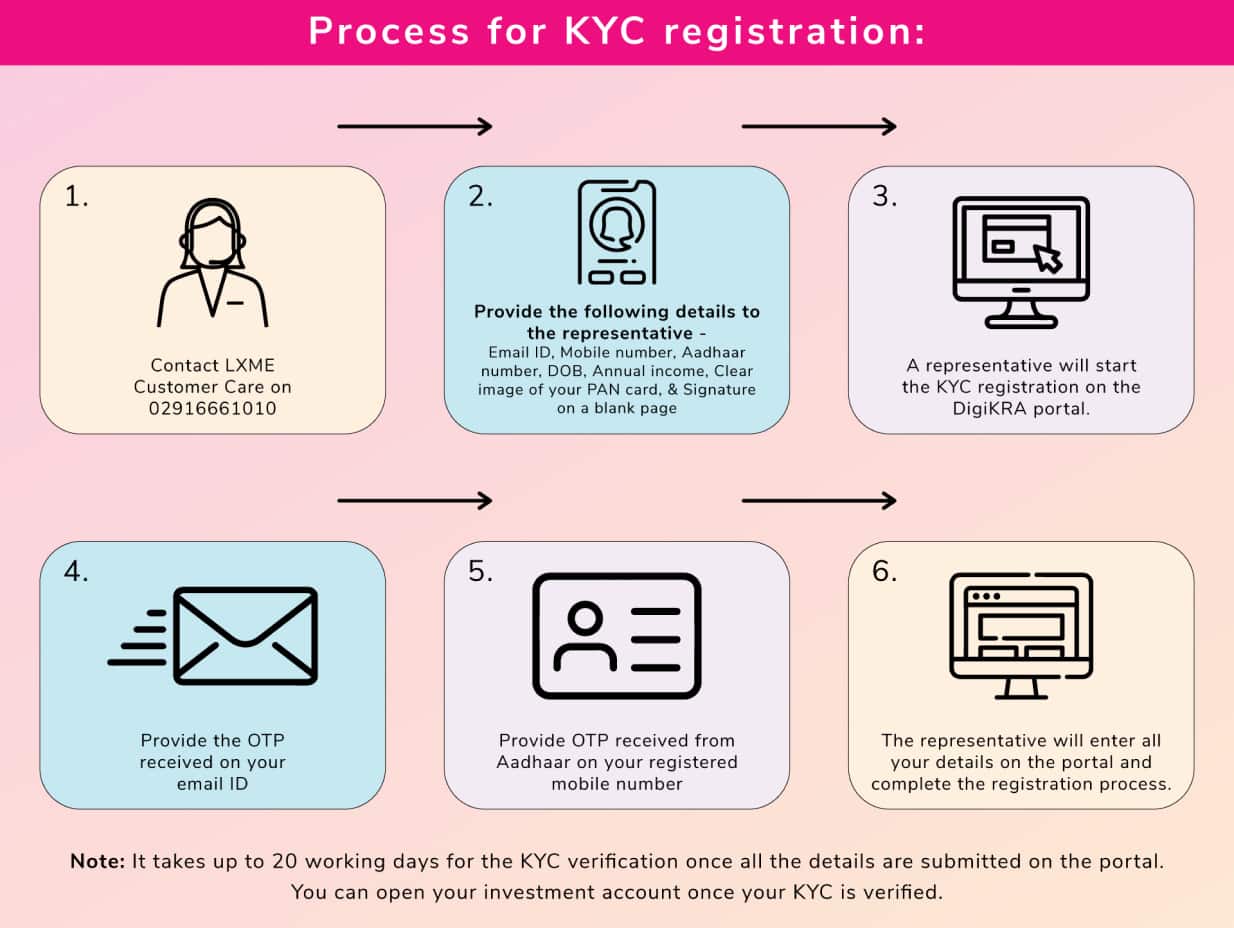

In case you are not KYC verified, worry not, we’ll help you complete you verification process!

- Contact LXME Customer Care on 02916661010

- A representative will start the KYC registration process on your behalf on the DigiKRA portal.

- Provide the following details to the representative-

Email ID, mobile number, Aadhaar number, date of birth, annual income, clear image of your PAN card, and signature on a blank page - The representative will sign you up on the DigiKRA portal for KYC verification using your email ID and mobile number. Provide the OTP received on your email ID.

- Provide OTP received from Aadhaar on your registered mobile number

- The representative will enter all your details on the portal and complete the registration process.

Note: It takes up to 20 working days for the KYC verification once all the details are submitted on the portal. You can open your investment account once your KYC is verified.

Remember we’re just a post or call away for help! Post your queries on the BeingLXME tab or call us at 0291-6661010.

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Mutual Funds Saving June 24, 2024

Saving vs. Investment: Which is better?

When it comes to money women are very disciplined in saving and budgeting. They can manage the expenses even in the tightest budget. They always think about the future like no one else can as they are proactive in all situations, so they always set aside some part of their budget for future or emergencies. … Saving vs. Investment: Which is better?

Saving June 6, 2024

Fixed Deposit vs Savings Account: Choosing the Right Path for Your Financial Goals

The journey to financial freedom is paved with smart decisions. As women, we navigate a unique financial landscape, and understanding the tools at our disposal and using the right investment platform is key. Two fundamental options we encounter are savings accounts and fixed deposits investments (FDs). But what’s the difference between a fixed deposit and … Fixed Deposit vs Savings Account: Choosing the Right Path for Your Financial Goals

Gold Saving June 1, 2024

Fixed Deposit vs Gold Investment: Choosing the Right Path for Financial Freedom at LXME

Empowering yourself with financial knowledge is a crucial step towards achieving financial freedom. At LXME, we understand that women often face unique challenges in the investment world. When it comes to building your wealth, you may be wondering: fixed deposit vs gold investment, which is the better option? Among other investment choices like mutual funds … Fixed Deposit vs Gold Investment: Choosing the Right Path for Financial Freedom at LXME