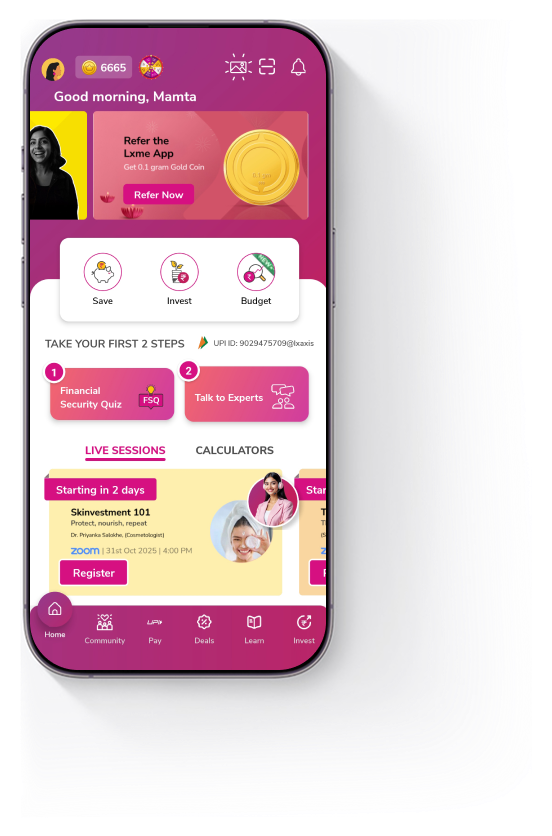

An INVESTMENT PLATFORM

MADE FOR WOMEN

Invest in Your Financial Future with Lxme – Empowering Women Through Smart Investments

Welcome to Lxme, where your financial well-being is our top priority. We understand the importance of safeguarding your money, and that’s why our platform is meticulously designed to ensure 24×7 security. With Lxme, you embark on a journey towards financial empowerment, guided by a team of experts dedicated to curating mutual fund investment plans tailored to meet your unique needs. Lxme is your one stop shop for all investments for women.

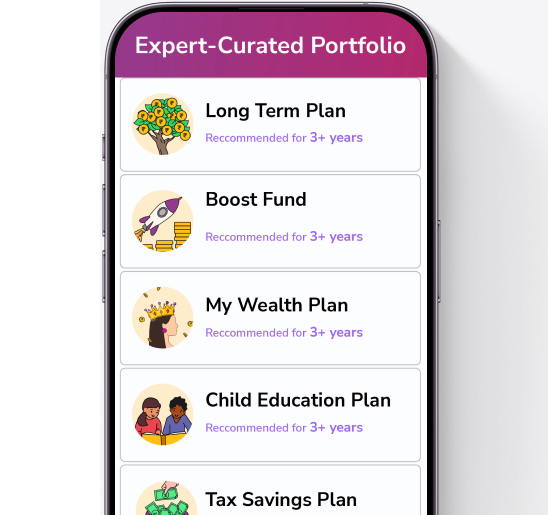

Mutual Fund Portfolios

Emergency Fund

CAGR

6.44%

Recommended for

short-term

Gratitude Fund

CAGR

18.35%

Recommended for

short-term

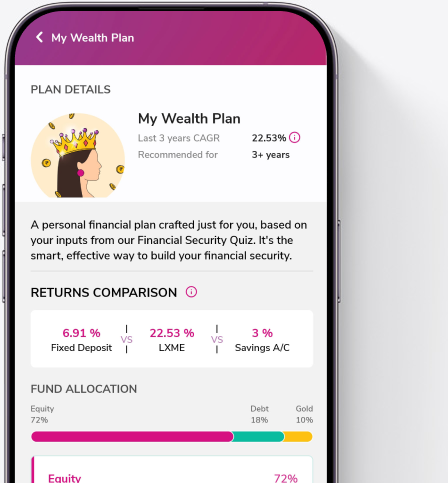

My Wealth Plan

CAGR

21.25%

Recommended for

3+ years

Boost Fund

CAGR

26.85%

Recommended for

3+ years

Child Education Plan

CAGR

17.74%

Recommended for

3+ years

Long Term Plan

CAGR

19.80%

Recommended for

3+ years

Short Term Plan

CAGR

9.62%

Recommended for

1-3 years

₹100 Equity Fund

CAGR

25.83%

Recommended for

3+ years

Ultra Short Term Plan

CAGR

6.39%

Recommended for

1 - 11 months

Tax Savings Plan

CAGR

18.80%

Recommended for

3+ years

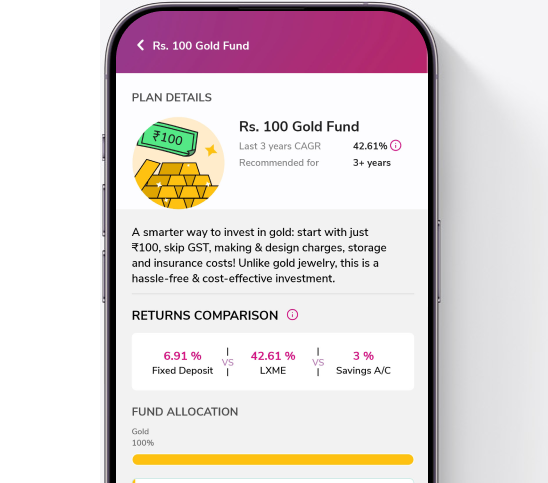

₹100 Gold Fund

CAGR

18.86%

Recommended for

3+ years

₹100 Debt Fund

CAGR

6.40%

Recommended for

short-term

Gulluck

CAGR

6.45%

Recommended for

3+ years

My Wealth Plan: Turbo

CAGR

18.31%

Recommended for

3+ years

My Wealth Plan: Advanced

CAGR

22.37%

Recommended for

3+ years

Why LXME?

Security First

Your money’s safety is our primary concern. Registered with AMFI- a body regulated by SEBI, our robust platforms is fortified to guarantee the security of your funds round the clock, providing you with peace of mind as you navigate the world of finances by investing in mutual funds online.

Hassle-Free Investing in Just 5 Minutes

Lxme believes in making investing accessible to every woman. Our Mutual Fund SIP investment platform is hassle-free, allowing you to start your investment journey in just 5 minutes. Experience the ease of navigating through the investment process with Lxme.

Start with as Little as Rs. 100

We believe that every woman should have the opportunity to make an online SIP investment, regardless of the amount. That’s why Lxme allows you to start investing in mutual funds investment plans with as little as Rs. 100. Your journey towards financial growth begins with a small but impactful step.

Expert-Curated Mutual Fund Portfolios

Our team of financial experts understands that one size doesn’t fit all. That’s why we curate mutual fund portfolios with precision, ensuring that the investment plans for women align perfectly with their financial goals and aspirations. At Lxme, you can get a wide-range of SIP plans for women and make an online SIP investment on this mutual fund platform.

Investment Plans Tailored for Women

- Lxme recognizes that women have unique financial needs. Our investment plans are tailored to address these needs, providing a personalized approach to financial growth.

- Systematic Investment Plans (SIPs) are a smart way for women to invest regularly. With Lxme, the SIP plans are designed to suit your financial goals and make investing a seamless part of your routine. Check out the specially curated SIPs for women on the Lxme App.

- Invest directly with our user-friendly platform. Lxme empowers women with the tools to take control of their investments and financial future. Explore investment schemes crafted exclusively for women, offering a diverse range of options to suit your preferences and financial objectives.

- Our mutual fund investment plans are tailored to align with your long-term financial goals, making it easy to build wealth with Lxme’s comprehensive solutions. Explore our carefully crafted schemes designed to match different risk appetites and investment horizons.

Additional Offerings for Financial Wellness

Find all your bill payers , all at one place.

Its easy, quick and rewarding to make bill payments with LxmePay

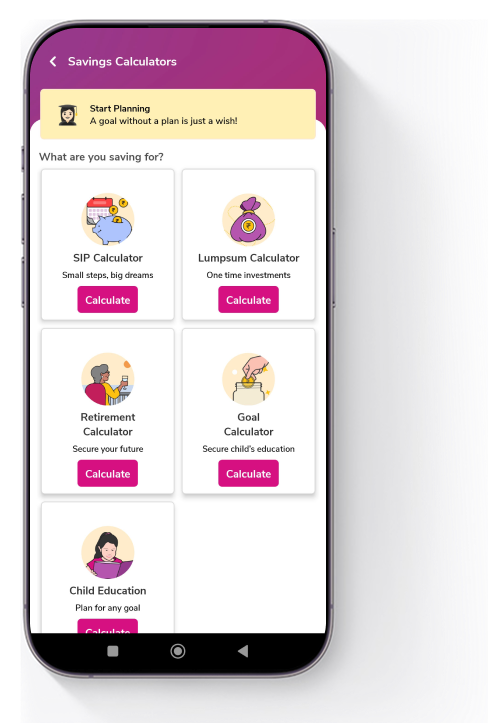

SIP Mutual Fund

Lxme’s mutual fund SIP investment options empower you to invest in mutual funds online in a disciplined and gradual manner, aligning with your financial goals and risk tolerance. Lxme’s investment schemes for women are expert-curated and rebalanced every few years keeping your goals in mind ensuring you get the most out of your hard-earned money.

Insurance for Women

Health Insurance for Women

Mutual Fund Investment App

Lxme isn’t just an app; it’s your gateway to financial freedom. Our user-friendly Mutual Fund investment app puts the power of smart investing right at your fingertips with customized online SIP investments.

Expert-backed Mutual Fund Plans

Explore the world of Mutual Fund SIP investments with Lxme. We provide the resources and expertise to help you make informed decisions for a secure financial future with SIP investment plans.

Your Financial Journey Starts Here

At Lxme, we are committed to empowering women on their financial journey. Our secure platforms, expertly curated portfolios, and diverse investment options are designed to be the ideal partner in your pursuit of financial independence. Choose from our range of online SIP investments for women and start building your future today—with Lxme, your financial future is our priority.

FAQ

How do I choose the best investment plan for women?

Before choosing any investment plan one should first assess their goals, time horizon, and risk appetite. Then based on these parameters you can choose the mutual fund SIP investment plans for women available such as equity, debt, gold, and fixed-income instruments. If you have a long-term goal i.e. of 3+ years then you can invest in equity mutual funds which have the potential to deliver inflation-beating returns or gold mutual funds or SGB which helps you hedge your investments against inflation. If you have a short-term goal i.e. of 1-3 years then you can invest in liquid investment options like debt mutual funds or any other liquid investment option. And if you want to get fixed returns then you can invest in fixed-income instruments like post-office savings schemes, FD, RD, etc. There are various investment plans with an option of investing in mutual funds online and investing in SIP plans for women or lumpsum plans..

However, ideally one should diversify their portfolio against all asset classes like equity, debt, gold, and fixed-income instruments to adequately manage their risk.

Are mutual funds safe to invest in?

Mutual funds are market-linked investment instruments so the returns one gets are in line with the markets. There are various types of mutual fund investment schemes for ladies on our mutual fund platform such as equity, debt, gold, etc. so their returns vary as per the respective markets. Choosing the right mutual fund investment requires a lot of research and expertise as there are 2500 Mutual Fund Schemes available in the market. On an average, it takes around 1400 hours periodically to select the best-suited Mutual Funds portfolio. So, our Lxme’s expert team does all the work for you and has curated best-suited mutual funds. You can check out the Lxme app to invest in mutual funds online and look out for various time and goal based portfolios which are diversified, well-researched and curated by experts.

Who can invest in SIP?

Anyone can invest in Mutual funds through SIP i.e. Systematic Investment Plan. SIP allows an investor to start their investments periodically where they can invest with as low an amount as Rs.100. Now investing for women doesn’t need a huge amount of money. You can check out Lxme’s Rs.100 Equity, Debt and Gold SIP mutual fund Fund and lumpsum funds which are well-researched and curated by experts.

What are the benefits of investing in mutual funds using the LXME app?

Lxme is India’s 1st Financial Platform for Women, Founded by Priti Rathi Gupta, who comes with 2 decades of experience in the Financial Services Industry.

1. The Lxme app is an uncomplicated investment platform for women to help you build your wealth. We have a wide array of goal and time-based baskets of mutual fund portfolios, tailored to cater to your financial needs. These mutual funds online are backed by the expertise exclusively for recommending, monitoring, and actively rebalancing the portfolio to beat the market and hence, generate the required alpha. Our expert team spends more than 1400+ hours on researching, analyzing, and curating the best-suited mutual funds for you out of 2500+ mutual fund schemes available in India. Get SIP plans exclusively for women on this mutual fund investment platform.

2. Lxme is an AMFI registered Mutual Fund distributor, regulated by SEBI. Lxme does not hold any funds invested by an investor, it is just a medium of investment. The actual money is with the AMC.

3. Track all your investments with clutter-free and secure dashboards with thi mutual fund investment platform.

Zero fees: No fee is charged from the users on the app when you invest in SIP and lump sum plans.

4. Get the right financial education: Learn from the Experts, MoneyCoaches, and your peers’ experience and knowledge about personal financial planning.