What is a SIP?

A ,SIP (Systematic Investment Plan), it’s a way of investing in Mutual Funds. It allows you to invest a fixed amount in a Mutual Fund regularly. A SIP is not a different product than mutual funds, nor is it a Mutual Fund’s category , it’s a way of investing. This method automates your investment, making it consistent and convenient. Every month a set amount will get deducted from your bank account and it will get invested in the chosen mutual fund scheme.

Why Should You Use a SIP Calculator?

It is a tool for investors who are looking for long-term payouts or beginners learning the craft of investment. Imagine baking a cake without seeing the recipe. You would probably make a mess, correct? Similarly, investing without a plan can lead to unpredictable outcomes. A systematic investment plan (SIP) calculator helps you to :

- Estimate your returns: To calculate your returns on the investments and how your money can potentially grow over the period of time.

- Plan your investments: You can plan and decide how much to invest and for how long you should invest as per your financial goals.

- Flexibility : SIPs offer flexibility, letting you adjust investment amounts, or change tenures to suit your financial goals.

With tools like the Sip investment return calculator, you can make informed decisions and stay on track.

How to use a SIP Calculator?

Let’s take an example,

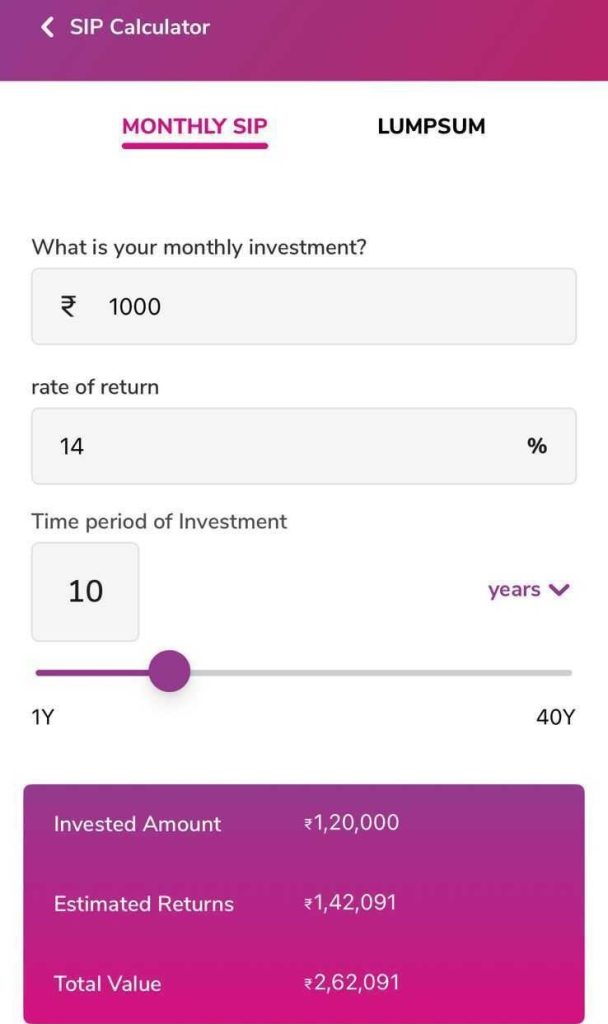

Rhea started SIP (Systematic Investment Plan), investments with ₹1,000 every month at an expected rate of 14% p.a.* for 10 years.

After 10 years, Rhea’s total fund value amounted to approximately ₹2.62 lakh.

(Note : The above example is for the Equity Oriented Mutual funds )

Think of it as a fitness tracker for your finances. Where you just have to enter:

The amount you plan to invest to achieve your desired goals.

The expected rate of return.

The duration of your investment (How long you want to be invested).

In seconds, you’ll see how your money could grow, helping you to set realistic goals and stay motivated for the investments.

LXME is designed to empower women to take control of their financial future. With our sip returns calculator, you can plan your investments with confidence.

Why Every Woman Should Consider SIPs :

As women, we often juggle multiple roles; caregiver, homemaker and professional. These responsibilities can sometimes lead to financial gaps. However, SIPs allow you to:

- Start with small amounts: You can start the investment even with ₹100 a month that can make a difference.To make investing even simpler, Lxme offers curated portfolios starting at just ₹100, designed to help you begin your financial journey with ease and flexibility.

- Invest regularly : Investing regularly through SIP helps you build a disciplined savings habit effortlessly, without straining your budget.

- Achieve your desired goals: SIP helps you achieve your desired goals like creating an emergency fund, buying a home, retirement fund, planning your dream vacation, or simply creating wealth.

Pro Tips for for women :

While calculating your SIP, consider the rate of return you can expect based on your horizon. sip returns calculator,(How long you have invested). For ultra short-term goals, debt or liquid mutual funds may be better. For short-term goals, risk can be controlled by safer debt instruments. And if you are making investments for the long-term period then equity, allow your money to potentially grow over time as you remain invested patiently.

Benefits of SIPs for Women :

Women’s financial journeys are often different; we might take breaks from our careers, juggle several responsibilities, or save for life events like marriage, having kids, or retiring early. SIPs can be an effective strategy for maintaining your financial stability during each of these stages. Here’s why:

Power of Compounding – The earlier you start a SIP, the more you benefit from compounding growth over time . SIPs work best with patience and a long-term view, making a disciplined way to build your wealth gradually.

Risk Management – Risk management is important. A well planned SIP with prudent asset allocation, aligned to your goals helps to reduce risk during market swings. It also allows your money to grow steadily, even during uncertain times.

Financial Independence – By contributing in a SIP investments, you can build your own wealth, make your own money decisions, and you eventually work toward financial independence

Ready to Take the First Step?

Your dreams are within reach. With the right tools and a little planning, you can make them come true. Start using the sip calculator on Lxme and take charge of your financial journey today!

FAQs

Can I calculate SIP for different investment goals?

Yes, you can calculate SIP as per your investment goals

How does a SIP calculator work?

First, enter the amount you want to invest and how long you plan to invest. Then, give the expected rate of return to estimate your possible growth.

Further read,