On 1st February 2026, the Finance Minister Nirmala Sitharaman presented the Union Budget 2026, where a few changes have been made, which you as a woman investor should know. In this blog, we’ll go through key budget 2026 highlights.

Let’s first understand what the Union budget is.

What is the Union Budget?

The Union Budget is the Government of India’s annual financial statement that presents its estimated receipts and expenditures for the financial year. Much like a personal budget helps you plan your income and expenses, the Union Budget serves as a comprehensive financial plan for the entire country.

It outlines:

- Tax policies and reforms

- Government spending priorities

- Economic growth strategies

- Investments in social welfare, infrastructure, and development.

Focus of Union Budget 2026:

This budget is dedicated to

- Yuva Shakti-driven growth

- Investment-led development

- Strengthening India’s investment & Startup ecosystem

- Enhancing ease of doing business and capital flows

- Long-term growth through infrastructure, skills, and innovation

Now, let’s look at the Key Budget 2026 Announcements.

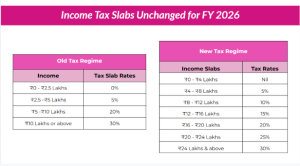

- Income Tax: No Change:

The government has kept the income tax framework unchanged, with no revisions to tax slabs or rebate structures. The existing tax regime continues as it is, and no new tax benefits or concessions have been announced in this budget. This provides tax stability and predictability for individuals and households, including investors.

- ITR Due Date Extended (Non-Audit Cases)

For non-audit taxpayers, except ITR-1 & ITR-2, the due date is extended to 31st August.

Applicable from FY 2025–26 (AY 2026–27)

ITR-3 & ITR-4 can now be filed up to 31st August

ITR-1 & ITR-2 due date remains 31st July

- Extended Timeline for Revised Returns

The revised return due date extended from 31st December 2026 to 31st March 2027

If filed after 31st December 2026, late fees will apply as per existing rules

- PAN-Based Challan for TDS (No TAN Required)

Buyers are no longer required to obtain a TAN

TDS can now be paid using a PAN-based challan

Reduces compliance burden for:

-

- Individuals

- Small taxpayers

- Buyback Tax Changes (Budget 2026–27)

Buyback income will now be taxed as Capital Gains for all shareholders

Additional buyback tax for promoters

Applicable tax rates:

-

-

- 22% – Corporate promoters

- 30% – Non-corporate promoters

-

- Tax Relief on Motor Accident Compensation

Interest received on MACT compensation is fully tax-exempt

No TDS will be deducted on such interest income.

Education & Skills: Learning Linked to Jobs:

- Industry-linked education: Development of five university townships near major industrial corridors to strengthen collaboration between education, research, and industry and improve employability outcomes.

- Access and inclusion: Establishment of girls’ hostels across districts to support higher education, especially in STEM (Science, Technology, Engineering, and Mathematics) and professional courses, helping reduce dropouts and build a skilled, job-ready workforce.

- Women Entrepreneurship: From Support to Scale

- Market access for women entrepreneurs: Introduction of She-Marts to enable women self-help groups to run community-owned retail outlets.

- Formalization and credit support: Proposed She-Mark certification to help women-owned businesses access finance and enter formal markets.

- STEM and research participation: Increased focus on encouraging women’s participation in STEM (Science, Technology, Engineering, and Mathematics), research, and innovation for long-term economic inclusion.

- Technology & Innovation:

- Innovation-led growth: Continued policy and funding support for artificial intelligence, deep tech, and advanced research to drive long-term economic growth.

- Semiconductor ecosystem: Expansion of initiatives under India Semiconductor Mission 2.0 to strengthen domestic manufacturing capabilities, research and development, and skilled talent creation.

- Infrastructure: Enhancing Connectivity: Seven new high-speed rail corridors have been announced to enhance connectivity, boost tourism, and support business growth across regions.

- Markets & Investments:

The budget revises the Securities Transaction Tax (STT) on derivatives, with rates increased for futures from 0.02% to 0.05%, options premium from 0.10% to 0.15%, and options exercise from 0.125% to 0.15%, while taxation on equity delivery and mutual fund investments remains unchanged.

Foreign Institutional Investors (FIIs) have been enhanced, with the individual investment cap raised from 5% to 10% and the overall limit increased from 10% to 24%, reflecting the government’s intent to encourage stable, long-term capital inflows.

- Overseas payments: The budget reduces the Tax Collected at Source (TCS) to 2% on foreign remittances for education, medical treatment, and foreign travel, making international payments more affordable for individuals and households.

- Healthcare: The budget exempts basic customs duty on 17 essential life-saving drugs and medicines, including provisions for seven rare diseases, reducing treatment costs and easing the financial burden on patients and families.

- Orange Economy & Creative Sectors: The budget introduces targeted support for the Orange Economy, including content creator labs in schools and colleges, and promotes sectors such as animation, VFX, gaming, and comics as emerging drivers of employment and creative growth.

- MSMEs & Biotech: The budget allocates ₹10,000 crore for SME growth and ₹72,000 crore under the Self-Reliant India Fund to support micro-enterprises, alongside a sustained multi-year focus on strengthening the biopharma and biotechnology ecosystem.

General Announcements:

- Center to develop 15 archaeological sites, including Lothal, Dholavira, Rakhigarhi, Sarnath, and Hastinapur.

- The tax holiday for foreign cloud service firms using India-based data centers has been extended until 2047.

- Public capital expenditure increased to ₹12.2 lakh crore, backing infrastructure growth and jobs.

- Fiscal deficit targeted at around 4.3 % of GDP, continuing consolidation path

- Rationalization of the definition of accountants for safe harbor rules to promote homegrown accounting firms.

- Proposal to form a joint panel of the Corporate Affairs Ministry and CBDT for incorporation of Income Computation and Disclosure Standards (ICDS).

- MAT (Minimum Alternate Tax) to be made final tax; rate reduced from 15% to 14%.

- Extension of deduction for cooperative members who supply cotton seeds and cattle feed.

- 3-year exemption on dividend income received by notified cooperatives on investments made up to Jan 31, 2026.

- 50% capacity will be increased in district hospitals by establishing emergency and trauma care centers.

FAQs:

How will the 2026 budget impact middle-income families in India?

The budget aimed to support middle-income families by maintaining tax stability, improving access to education and healthcare, and creating new opportunities through infrastructure, skill development, and employment-focused initiatives.

Are there any new tax rebates or changes in tax slabs announced in the 2026 budget?

No, the 2026 budget did not announce any new tax rebates or changes to the existing tax slabs.

How does Budget 2026 impact women investors specifically?

It helps women investors by providing tax stability, simplified compliance, improved access to education, employment, entrepreneurship, and growth opportunities to plan, invest, and build wealth with confidence.

📌 Bookmark this for your future reference.

💬 Comment ‘Insightful’ if you found this post informative.