Discover the groundbreaking RBI e-rupee, a digital currency initiative by the Reserve Bank of India, as we delve into all the essential details about this innovative financial development. Explore the ins and outs of the RBI e-rupee and its potential impact on the Indian economy in this informative LXME blog.

Are you ready to digitize?

The world is undeniably transforming digitally with rapid innovations in new technologies. We are all surrounded by digitalization. By enhancing connectivity, financial inclusion, access to trade, and public services, technology has made our life easy.

The launch of UPI (Unified Payments Interface), has made payments easy just by bringing the process to everyone’s fingertips. In less than a minute, people can send money to the recipient’s bank account using UPI apps linked to their bank accounts.

This year, on 1st December 2022, the Reserve Bank of India launched the pilot of Central Bank Digital Currency (CBDC) i.e., E-Rupee in the retail segment. So, now you might be wondering why is digital currency launched, as we already have physical currency as a means of exchange.

So, to answer this question, why it launched is, RBI believes that the digital rupee system will “boost India’s digital economy, enhance financial inclusion, and make the monetary and payment systems more efficient.”

What is E-Rupee?

E-rupee is also called Central Bank Digital Currency (CBDC) which is nothing but an electronic form of money that can be used in contactless transactions.

As per RBI, “CBDC is the legal tender issued by a central bank in a digital form. It is the same as a fiat currency (government-issued currency) and is exchangeable one-to-one with the fiat currency. Only its form is different.”

Types of Central Bank Digital Currency

- Retail CBDC (e₹-R): It would be potentially available for use by all in the retail segment i.e., by the public. (applicable to all of us)

- Wholesale CBDC (e₹-W): It would be only available in the wholesale segment i.e. to financial institutions.

Benefits of Central Bank Digital Currency:

- Digital currency will enable more efficient and secure payments

- It will complement the current form of currency i.e. physical currency. You can use both types of currency, physical as well as digital.

- This is will improve international payment options

- It can neither be torn, burnt, or physically damaged nor physically lost. It is more durable compared to physical notes.

- No fear of fake currency.

Drawbacks of Central Bank Digital Currency:

There are a few drawbacks also which also come up along with benefits:

- Privacy can be an issue as there is a loss of ability to transact anonymously.

- Increased cyber security risks, vulnerability testing, and costs of protecting the firewalls.

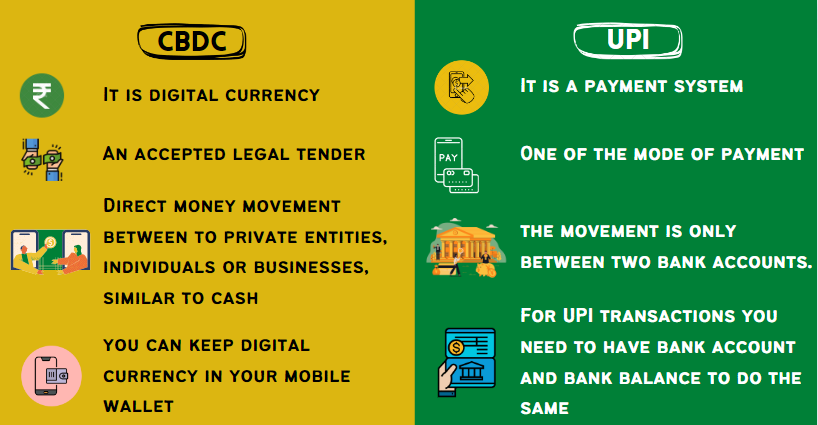

Difference between UPI and Central Bank Digital Currency

When digital currency was launched many doubts were raised in the minds of people regarding what is difference between UPI and Digital currency so, here it is:

- The major difference between UPI and CBDC is that – CBDC is a digital currency that can be used for various financial transactions while a UPI is a payment system that enables digital payments between participating banks and financial institutions.

- CBDC is accepted legal tender in India besides UPI is one of the modes of payment.

- CBDC can enable the movement of money directly between two private entities, individuals, or businesses, similar to cash. While in UPI, the movement is only between two bank accounts.

- As you keep physical currency in your wallet similarly you can keep digital currency in your mobile wallet. Although, if you want to do UPI transactions you need to have a bank account and bank balance to do the same.

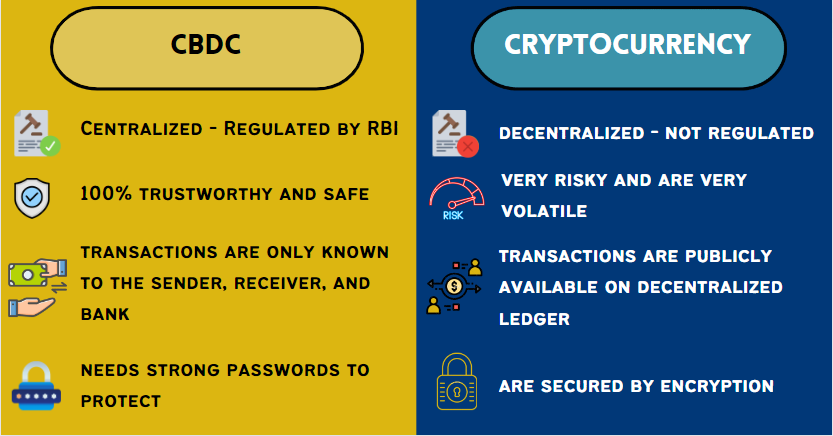

Difference between Cryptocurrency and Central Bank Digital Currency:

- One of the major differences between CBDC and cryptocurrency is that – CBDC is centralized means it is controlled by RBI however Crypto is decentralized i.e., not linked to or regulated by any government.

- CBDC is a legal tender so it’s issued by RBI. So, it will be 100% trustworthy and safe. Whereas, cryptocurrencies are very risky and very volatile.

So, to sum up, now you might be thinking that now digital currency will replace physical currency, so the answer is NO, digital currency will not replace physical currency, however, will act as an additional payment instrument.

This digital rupee is not very different from bank notes but being digital it is likely to be easier, faster, and cheaper for wholesalers as well as retailers to transact.

Related Article You may Like :- Here’s Why & How You Need to Start Investing to Crush Those

FAQs – Common Questions on Digital Rupee/E-Rupee

What is RBI’s e-rupee initiative?

The RBI e-rupee is a digital currency project launched by the Reserve Bank of India to explore the feasibility of introducing a digital version of the Indian rupee.

How does the RBI e-rupee work?

The RBI e-rupee operates on blockchain technology, allowing for secure and transparent transactions. It aims to offer a digital equivalent of physical currency.

What are the benefits of RBI’s digital rupee?

The digital rupee can enhance financial inclusion, reduce transaction costs, and provide easier access to banking services for the unbanked and underbanked populations.

How will the RBI e-rupee impact the Indian economy?

The e-rupee has the potential to revolutionize India’s financial landscape by increasing efficiency, reducing fraud, and promoting digital payments.

Unlock Financial Empowerment with LXME! 💰🌟

Watch our YouTube video: 5 Easy Steps to Open Your LXME Investment Account and take control of your financial future today. Don’t miss out!

To stay connected with LXME and access inspiring content, follow us on Instagram and subscribe to our YouTube channel.

Share this blog with your family and friends if you find it insightful!!

Download the LXME app now to start investing!

New Investor? Request a Callback.

Fill in your details and we will guide you at every step

other blogs

Smart Money April 17, 2024

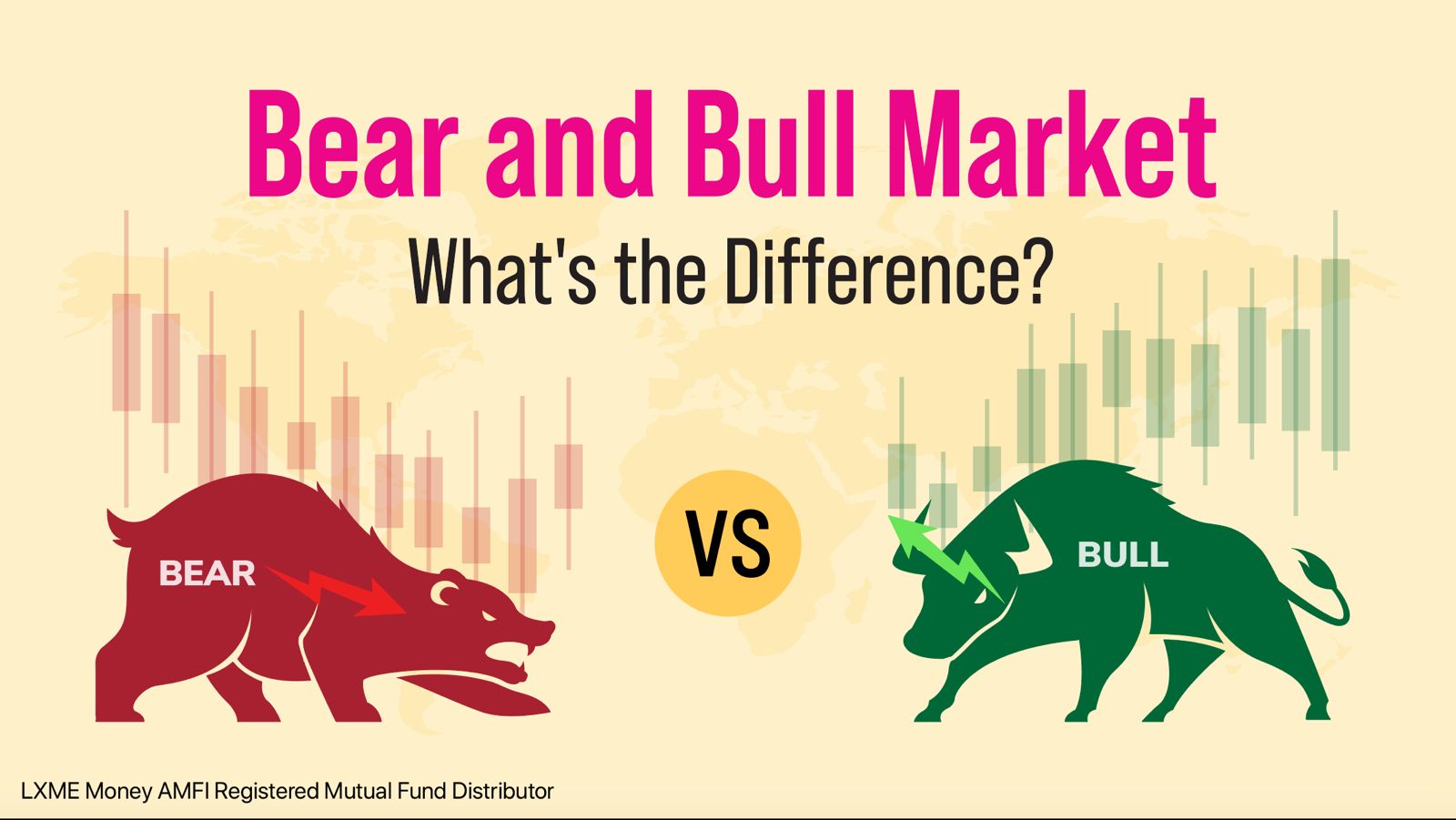

Bear and Bull Market: What’s the Difference?

In bear markets, prices are falling, investor confidence is low and the economy is declining. While, in bull markets, prices are rising, investor confidence is high and there is good economic growth. You must have heard the terms ‘bullish market’ and ‘bearish market’ on the news. But, what do bear and bull market mean? Is … Bear and Bull Market: What’s the Difference?

Smart Money

What is Udyogini Scheme? Features, Eligibility & Documentations

Financial assistance has the power to transform a woman’s life, especially an underprivileged woman. This is why the Women Development Corporation offers a scheme called Udyogini Yojana to provide women with monetary help in setting up their business. What is the PM Udyogini Yojana Scheme? What are some Udyogini Scheme details? Let’s find out! What … What is Udyogini Scheme? Features, Eligibility & Documentations

Smart Money April 11, 2024

Mahila Udyam Nidhi Scheme: Eligibility Criteria, Interest Rate & More

The Mahila Udyam Nidhi Scheme aims to support women’s entrepreneurial ventures. It is an initiative by the Small Industrial Development Bank of India and offers financial assistance to women entrepreneurs at special interest rates. Women have proven that they can do anything they set their minds to. Against all odds, women are setting up their … Mahila Udyam Nidhi Scheme: Eligibility Criteria, Interest Rate & More